With the markets going up and up, it is pretty hard to find companies that would look undervalued at the moment. Nevertheless, I am always on the lookout and am trying to continue our journey to financial independence. The only way I see for it to move forward is to save part of our income and invest it to assets that would provide some stable cash flow.

My most recent watchlist covered a list of Utility sector companies but none of them looked attractive at their current prices. Since I had enough capital for a purchase at the beginning of the month, I decided to change direction and buy some shares of a company which looks undervalued to me at the moment.

CVS Health (CVS)

The company that caught my attention is a giant healthcare corporation, pretty common in portfolios of dividend investors. Shortly about the company:

CVS Health Corporation, incorporated on August 22, 1996, together with its subsidiaries, is an integrated pharmacy healthcare company. As of December 31, 2016, the Company had more than 9,700 retail locations and more than 1,100 walk-in healthcare clinics.

Different to general market, its price keeps decreasing this year.

Share price decreased from ~$82/share in December 2018 to as low as $51.93/share last week.

Let’s try to find out why the price decreased and if it looks attractive in the long term.

Debt

The decline started at the end of last year, when company acquired Aetna Inc. for a combination of cash and CVS Health stock. Including Aetna’s debt, the total value of the transaction was approximately $78 billion. To finance the deal, CVS issued approximately $45 billion of new debt.

The balance sheet doesn’t look good as a result. Company now has $71.4 billion in long-term debt. Shareholder’s equity stands at $58.5 billion so Debt/Equity ratio is currently 1.22. Debt/EBITDA ratio currently stands at 5.15 which is really high and this is the biggest concern I have about the company. However, I believe that CVS can generate enough cash to pay its debts and the main target for the company is going to be to reduce debts in the upcoming years. Which leads me to the next point – dividends.

Dividend

Company currently pays $2/share in dividends annually and they haven’t increased the dividend in 2018. Actually, it is going to stay this way for at least a couple of years. In the latest quarterly report company announced that they are going to suspend dividend increases, share buybacks & acquisitions until they get the debt to desired level. So I think that the company will only start increasing their dividend in a couple of years as the earliest (probably in 2021) if everything goes according to plan. Even without the raise, the yield of 3.77% looked attractive at my purchase price. With the payout ratio at 28% there is definitely room to raise the dividend once the debt is back in control.

Purchase Summary

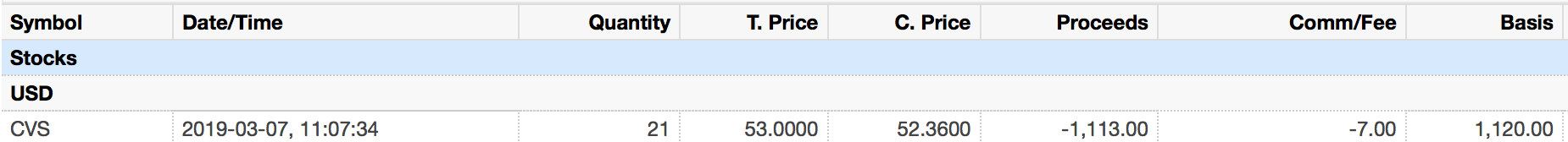

On the 7th of March I purchased 21 shares of CVS for $53/share for a total of $1120:

This purchase adds $35.70 to our Projected Annual Dividend Income (after taxes).

Trying to catch a falling knife is a risky move but it was hard to resist buying CVS shares at these levels. Time will tell if it was a right decision. It feels good to be one small step closer to financial independence, though.

Do you have CVS in your portfolio? Do you think it’s too risky and the debt level is too high? Have you purchased anything else recently? I would love to hear your thoughts!

Photo by Jordan Lomibao on Unsplash

Debt/EBITDA 5x is too high. Dont think your risking to buy into another Kraft Heinz? I did just that mistake and ignored the big leverage… now I paid the price 🙁 this is the lesson I learned the hard way – leverage matters 😉

I agree that it is very high but I decided to take the risk. I hope that it’s already calculated in the current share price but we will see what the future brings. This is for the long term so I would like to check it after 3 years 🙂

Kraft Heinz is similar regarding debt but the sector makes the difference, in my opinion.

Weeeel drug stores are very much in threat of e-commerce. So its aquestion which is more risky sector 🙂 interesting times for div payers. All bussnises are exposed to some sort of risk. Oil, tabbaco, food, retail, telcos, planes. Im starting to wonder if there is a true safe investment anyware… good old railways maybe 😀

CVS will continue to drop. It is early to buy.

Well, that’s a really bald statement. Do you have some criteria/price point when it is not early?

While I find the price tempting right now, I can’t bring myself to open a position given their debt and freeze on the dividend. I’ve been contemplating Walgreens as an alternative if I opt to open a position in this space. Hopefully it works out for you!

Thanks for the comment DivvyDad! You may be right and I agree that there are many risks involved. I took the risk and hope that it will turn out well in the long run. I didn’t want to miss the yield but it may be a mistake indeed. Only time will tell 🙂

Nothing wrong with risks as long as you are aware of them and take them into account, and it sounds like you definitely have done that. I do think that as you look at this with the long-term view, your decision will have been fruitful but it may just be a bumpy road in the near-term. Or it might not be bumpy, nobody knows until they know. 🙂

Thanks for putting CVS on my radar… it’s a much better buy than it was in 2015. Although, I’m still hesitant to jump in.

Thanks for visiting! I agree that it’s quite risky but hopefully it will work out in the long term.

I’ve always wondered when one of these health store giants will be bought by another. Who do you think has more sustainability, Walgreens or CVS. You also have to factor in the e-commerce syphon. Who can stay more relevant online?

Thanks for visiting Retirement Gift! To be honest, I am not familiar too much with Walgreens, so it’s hard to say. I can see that they are down by 13% today after their latest earnings results and are dragging CVS down as well which is down 3% today 🙂

CVS has been doing really well since you published this. I don’t know if that’s a coincidence or not but you should post another profile. Preferably something in my portfolio ; ) !!!!!!

Haha, thanks! Well, they were up by quite a bit since I purchased them but they are back down now. It seems that it’s going to be a bumpy ride 😀