Hello and welcome to overview of the first month in 2019. End of January means that we only have one month of winter left. And the first two months of winter were not disappointing. I don’t remember when was the last time we had so much snow. I hope that we will have similar winter next year, as I would like to be able to build some snowmen with our baby-daughter when she grows a little bit.

Enough with the weather overview, though. Let’s get to the numbers for January.

Dividend Income

This month I received dividend from 3 companies:

The first month of the quarter was historically the slowest month for dividend income. It was the only month when I wouldn’t reach $10 in dividends. Well, that’s about to change with a recent addition of ITW to my portfolio. It’s nice to start the year with another small milestone 🙂

It’s already a tradition to imagine what part of our expenses in relevant categories we would be able to cover if we decided to spend the dividend:

- $8.70 from Cisco would cover 8.6% of our Internet + TV bill for the last three months;

- $6.80 from Illinois Tool Works would cover 17% of our Home expenses category for the last three months;

- $2.48 from Realty Income would cover 0.4% of our monthly Rent.

I like to perform this exercise because it gives me motivation to keep saving and investing. Hopefully, one day dividends will be able to cover at least some of our expenses each month.

Year-On-Year Comparison

Let’s see how dividend income compares to what I received in January of last year:

It’s great to see that dividend income more than doubled compared to last year. It happened due to several reasons:

- Addition of ITW to my portfolio;

- I moved CSCO from my previous broker to a new brokerage account and had to pay 15% tax as opposed to 30% earlier;

- CSCO & O increased their dividends in 2018.

I hope to continue the momentum, as I have an optimistic goal to double passive income this year compared to last year.

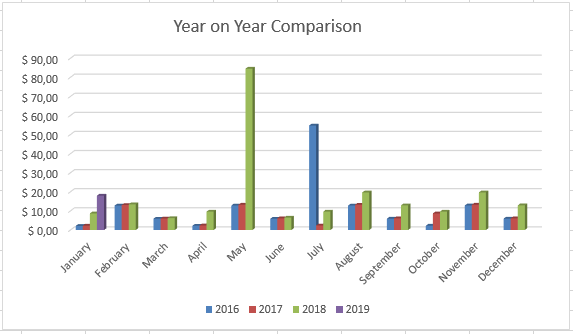

This is how my dividend income progress looks like since the beginning of 2016 when I started recording it:

Purchases and Portfolio Contributions

During January I contributed €600 to my investment account. I used this amount and previous savings to initiate one position. On the 2nd of January, I bought 15 shares of TGT for $66.59/share (+ $7 commissions) for a total of $1005.85. You may read more about this purchase here.

I also added €50 to P2P lending account.

Dividend Increases

This month one company increased their dividend. It’s one of my favourite companies – Realty Income:

The increase is not big but they tend to raise their dividend very often, so I’ll take that.

Changes in Projected Annual Dividend Income (PADI)

At the beginning of the year, I created a goal for myself to increase PADI to $450. It was standing at $236 at the end of last year which means that I should increase PADI by ~$18/month if I want to achieve the target. To better track my progress I decided to include a new table to my monthly reviews (I borrowed the idea from EngineeringDividends with his consent). It will show how much additional forward dividend income is added to my portfolio each month from dividend raises and investment of new capital.

January was a great month and it added $33.24 to my Projected Annual Dividend Income. Most probably, I won’t be able to add much during February, so it’s good to be ahead of schedule for now.

P2P Lending Income

This month I received €8.19 in interest from P2P lending. My loans portfolio currently consists of 66 loans for a total value of €730.07.

Summary

In total (after converting to EUR) I received €23.88 from passive income during January. I am aiming to receive €480 during 2019, so I am currently behind my target. However, I hope that the target is reachable if I keep saving and investing 🙂

How was your January? Did you receive dividends from any of the companies above? Was the weather cold where you are writing from? As always, thanks for reading and I would love to read your comments!

Hi BI. Congrats with your first month. Going to the right direction 🙂 CSCO is also on my radar, but im switching to cash accumulation for now. Alteasts it will be more clear re brexit in March. As you know I predick hard brexit and all market bets for defer or even 2nd referendum. Either way good buch of recesion proof dividend payers you got there 😉

Hi P2035,

Thanks for the comment! It is true that there is a lot of uncertainty but I think we will survive whatever happens. I personally like the approach to keep investing and not try to time the market too much. But having some emergency fund is also good for unexpected events and I am trying to have one as well 🙂

Talking about Brexit specifically, my bet would be that it will be delayed. I don’t want to believe that hard Brexit will happen but its probability has definitely risen recently. We’ll see what happens shortly.

You were able to double your dividend income from last January, which is great a start to the year! Target looks a like a good addition to your portfolio too.

Hi DD,

Thanks for the comment and encouragement! It will be hard to keep this kind of momentum going forward but I’ll do my best 🙂

Good job growing your income, BI! There is nothing to complain about seeing such growth rates.

I’m looking at CSCO, too. My PF is quite underrepresented in the technology sector. Would love to grab some shares but I think the valuation is a bit rich at the moment.

All the best for your goals in 2019.

Thanks for the comment SF!

I agree that the price of CSCO is quite high at the moment. I purchased it for $32/share back in September 2017.

Good luck for you in 2019 as well!

You are so patient!!! I am making very little dividend and feel bad about myself. Keep on working!!

Thanks Yingjie! I don’t think it’s a lot, especially if I would compare that with other bloggers I am following 🙂

Great start to 2019. Your 3 payers are all solid known dividend stocks. Keep building on those positions and others. ITW was one of my first dividend stocks I bought since going the DGI route about a decade ago. Keep up the good work.

Thanks a lot DivHut! I will do my best to build the portfolio and continue on this path 🙂

Great update BI, and that is fantastic growth to double your payout since last year! The addition of ITW looks to be paying off quite nicely for you. I share O with you this month, and also own TGT that you added (and at a great price too in my opinion).

Love the PADI table as well, which I too inherited from ED after seeing it on his site. I’ve actually added a handful of things to my tracking that I first learned about via his site, and glad that he was open to sharing that with me. You’re off to a great start for the year!

Thanks for the nice words DivvyDad! Regarding TGT, it was even lower when I started considering them but I was too afraid to try catching the falling knife. Anyway, I am happy to have pulled the trigger eventually and their price recovered by ~8% since I purchased them.

Yep, ED definitely has some ideas that are very useful for tracking our progress from different angles. I can tell the same about your site, especially fun with Excel/spreadsheets series 🙂

More than double the dividends, BI. That’s the way to start the new year!

I share O and ITW with you this month. I own your new addition TGT as well and actually added to my position at essentially the same price you initiated your position.

Glad to see the additional forward dividend income table. It looks great. Too bad you don’t have the row for reinvested dividends. I don’t recall… is that not an option at your brokerage, or is it just cost prohibitive?

Regarding the weather… I know it’s been very cold in many places around the globe , but I’m not a cold weather guy. Thankfully, I live in a place where it doesn’t snow, as it rarely gets cold enough. At worst, we might dip below freezing overnight for a few days each year. Sound strange?

Oh, I was hoping to add a line for reinvested dividends. Unfortunately, dividend reinvestment is possible but not practical at my broker. You may only purchase whole shares and have to pay standard commissions, so it wouldn’t make much sense to pay $7 in commissions to purchase 1 share of some company 🙁

Regarding the weather, you are quite lucky. We usually have at least a couple of weeks below -20 Celsius during winter 🙂

You are absolutely off to a great start BI as all previous commenters already mentioned. Your ITW buy is starting to show its strength as well. Couldn’t be happier for you my friend, keep up the grind and don’t forget to have fun along the way! 🙂

Thanks a lot Mr. Robot! The same goes to you 😉