The most important thing at my current portfolio phase is to save part of my income and invest it to attractive stocks. I don’t believe in get-rich-quick schemes, so I keep saving every month and slowly build portfolio of companies that pay dividend. I hope that one day it will be able to cover some expenses of our family. The earlier we start investing, the bigger impact it will have.

I usually make a watchlist of a few companies that look attractive to me and make an investment decision based on that. That’s what I did at the end of December. Three companies in retail sector caught my attention that time: Bed Bath & Beyond (BBBY), Williams & Sonoma (WSM) & Target (TGT). Out of those three companies, I decided to go with the last one.

I chose Target for a few reasons – high dividend yield, historically low P/E ratio, low dividend payout ratio and long history of dividend raises.

Shortly about the company:

Target Corporation (Target), incorporated on February 11, 1902, is a general merchandise retailer selling products through its stores and digital channels. The Company’s general merchandise stores offer an edited food assortment, including perishables, dry grocery, dairy and frozen items. Company’s digital channels include a range of general merchandise, including a range of items found in its stores, along with an assortment, such as additional sizes and colors sold only online. The Company’s owned brands include Archer Farms, Market Pantry, Sutton & Dodge, Art Class, Merona, Threshold, Ava & Viv, Pillowfort, up & up, Boots & Barkley, Room Essentials, Wine Cube, Cat & Jack, Simply Balanced, Wondershop, Embark, Smith & Hawken, Xhilaration, Gilligan & O’Malley, Sonia Kashuk, Knox Rose and Spritz.

Purchase Summary

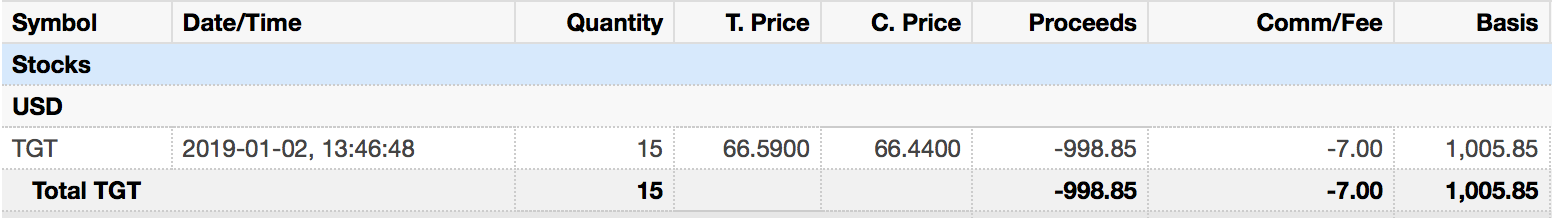

On the 2nd of January, I bought 15 shares of TGT for $66.59/share + $7 commissions for a total of $1005.85:

Some facts about the company at my purchase price:

- Dividend yield: 3.84% (before taxes)

- Payout ratio: 42.5%

- Dividend raise streak: 47 years!

- P/E (TTM): 11.76

- Debt to Equity ratio: 1.05

This purchase adds another dividend aristocrat to my portfolio! I love the fact that they keep raising their dividend for so many years in a row and I hope this is not going to stop.

This purchase will increase my PADI (Projected Annual Dividend Income) by $32.64 (15 * 2.56 – 15% tax). It brings my current PADI to $271 and I have a goal this year to bring it to $450.

What do you think about this purchase? Do you have Target in your portfolio? Are you trying to avoid Retail sector or still like it? I would love to hear your opinion 🙂

Nice buy BI. I bought TGT back in y2017 for 56$/share. They are a bit behing on e-commerce so they can have some problems in the future. This is why their yield and p/e is so good. But I think they should adapt.

Thanks P2035. We will see how it goes. I definitely hope that they will be able to adapt to the changing environment 🙂

And I would not look at debt/equity ratio. Equitu/total asset is a better ratio and if your looking if the company is not leveraged you should look at NetDebt/EBITDA ratio. Look our for ones with >3. These two ratios are key component of snp and moodys ratings.

Thanks for the advice! 🙂

I like it, BI. I made a purchase of TGT at essentially the same price last month. Hard to argue with their performance over the years. Sure, they have some challenges, but all companies do. Congrats on a nice addition.

Thanks ED! Happy to be a fellow shareholder in the company 🙂

Nice purchase BI, I’m a fellow shareholder and added to my position late last year. I really like TGT and I can attest to the fact that my wife tries to do her part to help their bottom line haha.

Haha, say thanks to your wife from me DivvyDad 😀 I am happy to become a fellow shareholder and hopefully the company will treat us well 🙂

Target looks like a great purchase! Also have some shares in my own portfolio.

Hi DD,

Thanks for the comment! Looking at the comments, it looks like Target is in most of the dividend growth investors’ portfolios 🙂