After more than two years since my last stock purchase, I am starting to build my stock portfolio from scratch. It feels really good to be back.

Let’s see which company I chose to restart the journey 🙂

Target (TGT)

My plan was to start stock portfolio by purchasing some company from Consumer Staples sector and I created a small Watchlist last month. After some consideration, I decided to go with the company I had in my portfolio before – Target (TGT).

Shortly about the company from Wikipedia:

Target Corporation (doing business as Target and stylized in all lowercase since 2018) is an American big boxdepartment store chain headquartered in Minneapolis, Minnesota. It is the seventh largest retailer in the United States, and a component of the S&P 500 Index. Target was established as the discount division of Dayton’s department store of Minneapolis in 1962. It began expanding the store nationwide in the 1980s (as part of the Dayton-Hudson Corporation), and introduced new store formats under the Target brand in the 1990s. The company has found success as a cheap-chic player in the industry.

I chose Target for a few reasons – historically higher dividend yield, long dividend growth history, decent debt levels and the fact that the company’s share price decreased considerably already during 2022.

Some facts about the company at my purchase price:

- Dividend yield – 2.83%

- Average 4-yr. dividend yield – 2.11%

- Payout ratio – 51.71%

- Dividend raise streak – 54 years!

- 5-year dividend growth rate – 10.17%

- P/E (TTM) – 19.82

- Forward P/E – 26.44

- Net Debt/EBITDA – 2.43

Target is not on a good footing this year. Due to supply-chain problems, it ordered too many items and needs to get rid of them under low prices. It also cut its guidance on earnings twice this year. On top of that, high inflation is hard on Target’s customers.

On the other hand, some of the bad news could already be priced in. It could provide an opportunity to get some shares cheaper if you trust the company in the long term.

Purchase Summary

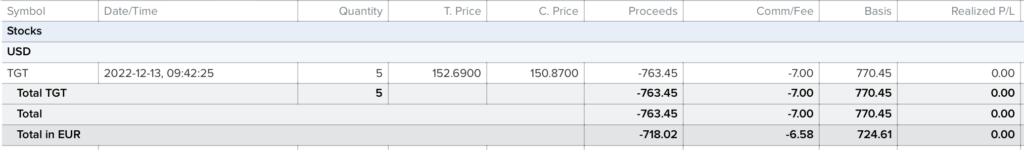

On the 13th of December, I bought 5 shares of TGT at $152.69/share + $7 commissions for a total of $770.45:

Size of the purchase is lower than what I would usually desire. However, I really wanted to initiate a position before the year’s end, so I made a smaller buy this time.

It adds $18.36 to my PADI (Projected Annual Dividend Income) after taxes.

It seems that I bought the stock too early, as the price keeps going down since the purchase. But I don’t have any intention to sell the shares for years, so I don’t care much about short-term price fluctuations.

Looking forward, I am only planning to initiate my next purchase in April or May. High inflation and rising interest rates on our mortgage took a dent in our savings, but it should start looking better in a few months, so we’ll just need to wait it out.

What do you think about the purchase? Is it too early to get back to market or do you prefer not to time the market? Do you have Target in your portfolio? I would love to see your comments and thanks for reading! 🙂