My most recent watchlist featured a list of REITs. It’s one of the sectors I wanted to increase my exposure to for some time already.

I was particularly interested in Industrial REITs, as I didn’t have any companies from this sector yet. However, the companies that I was watching either looked too risky or the valuations seemed too high. So I was waiting in the sidelines with some price targets in mind. Fortunately, there was a dip and I was ready to initiate a new position in my portfolio.

Company Overview

Prologis is the biggest Industrial REIT in the world. Shortly about the company from their Investor Relations page:

Prologis, Inc. is the global leader in logistics real estate with a focus on high-barrier, high-growth markets. As of December 31, 2019, the company owned or had investments in, on a wholly owned basis or through co-investment ventures, properties and development projects expected to total approximately 964 million square feet* (90 million square meters) in 19 countries. Prologis leases modern logistics facilities to a diverse base of approximately 5,500* customers principally across two major categories: business-to-business and retail/online fulfillment.

Company is well diversified. Here is a short overview of company’s assets from its latest Investors FactSheet:

I also like this overview of type of goods in their buildings and main customers:

Let’s run through company’s numbers at the purchase price (on the 1st April):

- Price – $72.00;

- FFO Payout Ratio (forward) – 68.12%;

- Net Debt/EBITDA – 4.84;

- EBITDA/Net Interest Expenses – 10.81;

- Net Interest Expenses/Net Operating Income – 18.09%;

- Debt/Total Real Estate Assets – 40.74%;

- Dividend Yield – 3.22%;

- Average 4-yr yield – 2.98%.

Of course, the valuations are historical and they will look worse in the upcoming quarters when the new data comes in. However, I feel that it’s one of the safer choices among REITs and it has some margin of safety.

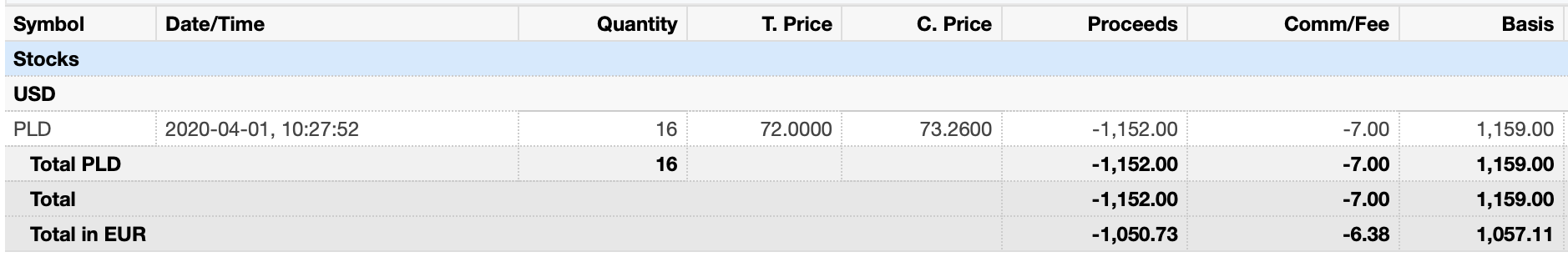

Purchase Summary

On the 1st of April, I purchased 16 shares of Prologis at $72.00/share for a total of $1159.00 (including commissions):

This purchase adds $31.55 to my net forward annual dividend income.

As a result, I now have a new REIT in my portfolio. My other REIT (Realty Income) is from Retail sector, and this one is an Industrial REIT, so it adds some diversification as well. I was lucky to lock in the price of $72/share as well, as it’s already ~27% up since my purchase. With the uncertainty in the market, I wouldn’t be surprised if the price drops again, though. The main thing is that they don’t cut their dividend.

What have you been buying lately? Do you have Prologis in your portfolio? What do you think about the company? I would love to read your comments! 🙂