September was quite an eventful month for my investments. I made 3 purchases in total. One of the investments went to a new company and I also made two small additions to existing companies in my portfolio. Let’s see what I bought this month.

Discover Financial Services (DFS)

Recently, I shared a watchlist of financial services that were in my radar. After some consideration, I decided to go with Discover Financial Services (DFS).

This is how company is described by Morningstar briefly:

Discover Financial Services is a bank operating in two distinct segments: direct banking and payment services. The company issues credit and debit cards and provides other consumer banking products including deposit accounts, students loans, and other personal loans. It also operates the Discover, Pulse, and Diners Club networks. The Discover network is the fourth-largest payment network in the United States as ranked by overall purchase volume, and Pulse is one of the largest ATM networks in the country.

Let’s see how main stats of the company look like at my purchase price:

- Purchase price – $89.90

- Current Price – $87.19

- Annualized Dividend – $2.80

- Dividend Yield – 3.11%

- Average 4-yr. dividend yield – 2.26%

- Payout ratio – 17.33%

- Raising Dividend Streak – 12 years

- 5-yr. average dividend growth – 12.39%

- P/E (TTM) – 6.04

- Forward P/E – 6.76

There’s a lot to like about the company at its current share price:

- Company pays a respectable dividend yield which is higher than company’s average yield;

- Payout ratio is sustainable at a very low level of 17%;

- Company keeps raising their dividend and recent growth rate is promising;

- Company is valued at a low P/E ratio of ~6.

However, this valuation doesn’t come without any risk. Recent growth in dividend yield and low P/E ratios are mainly due to concerns with the company and therefore dropping share price:

- Back in July the company announced that “it misclassified certain credit-card accounts into its highest merchant pricing tiers for years and that it would be working to compensate merchants and merchant acquirers for the issue“;

- Company’s CEO left the company recently and DFS is looking for a replacement;

- Share buybacks were paused due to ongoing legal issues;

- Net income dropped 18% year-on-year for the second quarter.

I listened to company’s most recent earnings calls and got an impression that the company is really focusing on compliance these days. They hired a lot of people in this area and probably the expenses of the company should be higher going forward.

There is a lot of uncertainty but I decided to take a risk and try to take advantage of the recent price drop in the company. We will see in the future if it was a right decision.

Purchase Summary

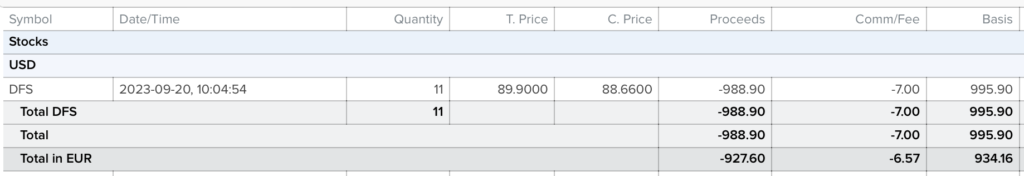

On the 20th of September, I bought 11 shares of DFS at $89.90/share (+$7 in commissions) for a total of $995.90:

With their current dividend yield, this adds $26.18 to our projected annual dividend income.

Other Buys

This month, I also added small amounts to my existing Lithuanian positions.

On the 20th of September, I bought 7 shares of Ignitis (IGN1L) at €20.5/share for a total of €143.50. This purchase adds €7.42 to my annual dividend income. I now own 25 shares of Ignitis in my portfolio.

On the same day, I also purchased 35 shares of Telia Lietuva (TEL1L) at €1.61/share for a total of €56.35. This adds €1.78 to my annual dividend income. After this purchase, my portfolio holds 130 shares of Telia Lietuva.

Summary

Investments during the month sum up to ~€1120. As a result of these investments, annual dividend income grew by €33.73 (at current EUR/USD rate).

Even though the road to financial independence is long, it feels good to be in a better position than we were yesterday.