I have accumulated enough funds for a bigger purchase, so now I am looking for a candidate to join my portfolio.

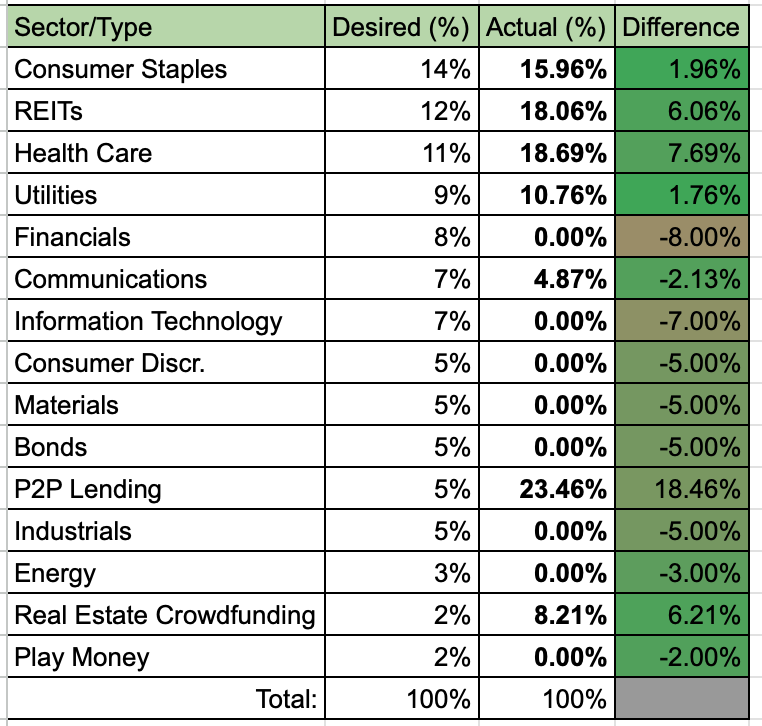

Looking at my portfolio composition, my next purchase should go to a company from Financials sector:

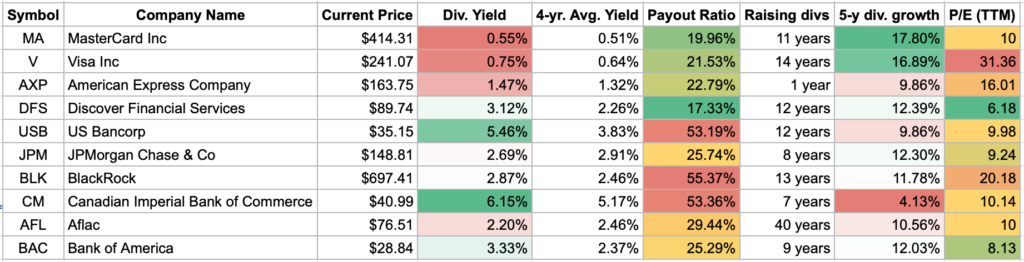

To start with, I came up with a list of 10 companies in the Financial sectors and compared some of the criteria, which seems important to me as a dividend growth investor:

Out of these 10 companies, I chose a shortlist of 3 companies I am going to look into a little bit deeper.

Discover Financial Services (DFS)

Shortly about the company from Morningstar:

Discover Financial Services is a bank operating in two distinct segments: direct banking and payment services. The company issues credit and debit cards and provides other consumer banking products including deposit accounts, students loans, and other personal loans. It also operates the Discover, Pulse, and Diners Club networks. The Discover network is the fourth-largest payment network in the United States as ranked by overall purchase volume, and Pulse is one of the largest ATM networks in the country.

Company is not having a good second part of the year so far. Back in July the company announced that “it misclassified certain credit-card accounts into its highest merchant pricing tiers for years and that it would be working to compensate merchants and merchant acquirers for the issue“. Further to that, the company received a proposed consent order from the FDIC in connection with consumer compliance. Following this, company announced an abrupt departure of its CEO in the middle of August. All of this doesn’t bode well for a financial company and it can be seen from its stock price. It lost ~26% of its value since mid-July.

On the other hand, this may present an opportunity. With recent pullback in share price, most of the ratios are looking very well compared to other companies I was looking at. Let’s look at some pros and cons of DFS.

Pros:

- Current dividend yield of 3.12% is higher than its 4-year average of 2.26%;

- Dividend payout ratio is very low (at 17%), which indicates safety of dividend;

- Company raised dividends for 12 years in a row and has 12% 5-year dividend growth;

- P/E ratio is also the lowest among the companies I added for comparison.

Cons:

- Uncertainty due to legal litigations. Company needs to preserve some cash for fines and impairments;

- Uncertainty due to CEO departure;

- Discovery paused their share buybacks due to regulatory issues;

- Net income dropped 18% year-on-year for the second quarter.

JPMorgan Chase (JPM)

Next in the list is a company which probably doesn’t need introduction. Being one of the biggest and most influential banks in the world, you constantly hear about them. Anyway, this is how Morningstar describes it briefly:

JPMorgan Chase is one of the largest and most complex financial institutions in the United States, with nearly $4 trillion in assets. It is organized into four major segments–consumer and community banking, corporate and investment banking, commercial banking, and asset and wealth management. JPMorgan operates, and is subject to regulation, in multiple countries.

During the regional bank crisis in US back in Spring, JPM came out as one of the few winners. While smaller banks were bleeding out customers, JPMorgan was the safe haven for them. It’s hard to bet against this bank and I don’t think you can go wrong by having it in your portfolio. On the other hand, perhaps it’s not the best time to initiate a position, as all the good stuff may already be included in company’s stock price.

Let’s try to come up with some pros and cons for the company.

Pros:

- One of the strongest banks in the US;

- Constantly growing net income;

- Jamie Dimon is one of the best CEOs in business, the only one from big US banks still a CEO since 2008 financial crisis;

- Sustainable Dividend Payout ratio of 26%;

- Constantly shrinking number of shares outstanding, due to share buybacks.

Cons:

- Current Dividend yield (2.69%) is smaller than company’s 4-yr. average yield;

- Strength of the business may be already priced in to share price, so perhaps it’s not the best time to initiate a position.

Canadian Imperial Bank of Commerce (CM)

Finally, we have one of the big six Canadian banks in my list. Briefly about the company from Morningstar:

Canadian Imperial Bank of Commerce is Canada’s fifth-largest bank and operates three business segments: retail and business banking, wealth management, and capital markets. It serves approximately 11 million personal banking and business customers, primarily in Canada.

This bank came to my attention due to a recent video from Dividend Diplomats. What stands out first about this company is its huge dividend yield of 6.15%. While it has one of the highest payout ratios among the companies I am reviewing, it is still less than 60%, which seems sustainable.

As with previous companies, let’s review some pros and cons of the company.

Pros:

- High dividend yield of 6.15%;

- Company’s stock price is close to 52-week low, which could be a good buying opportunity.

Cons:

- Dividend growth rate is slow (4.13% in average during the last 5 years);

- Three-fold jump in bad loans provisions was reported during their latest earnings report;

- Bank is exposed to more loan defaults due to high interest rates.

Summary

There you have it – 3 companies from Financials sector that look interesting to me at the moment. It’s a challenge to evaluate companies from this sector and I am not pretending to be an expert. So I am mainly focusing on what interests me as a dividend investor.

I will probably initiate a position into one of these companies next week. Which company from the list would you go with? Do you have some other favorites from Financials sector? I would love to read your comments!