Markets are on a downtrend lately. The fall of Silicon Valley Bank has put some more gas to the fire and I can see that S&P 500 is down by almost 5% over last week. However, I am of opinion that it’s always a good time to buy and try not to pay attention to market fluctuations.

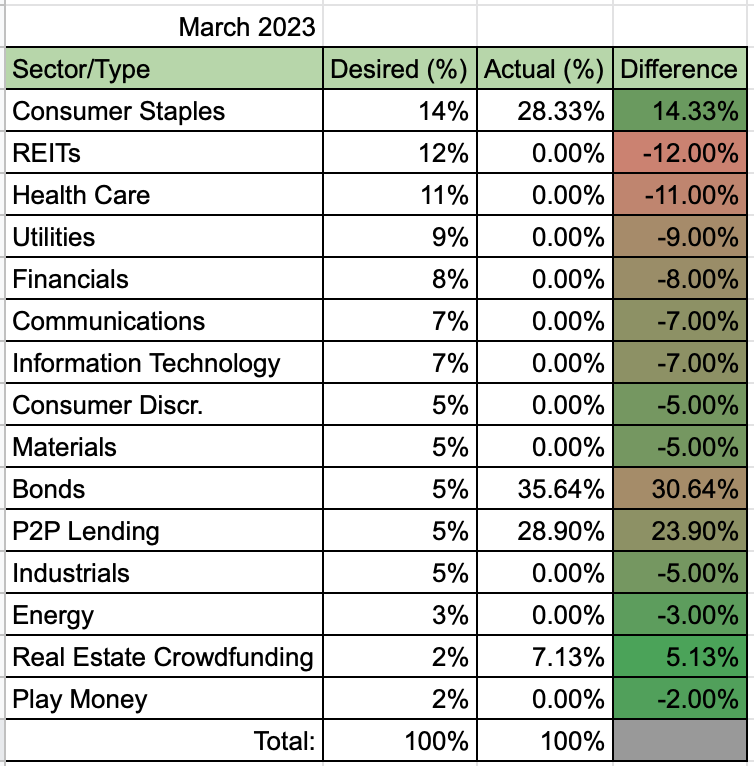

I will have enough funds to initiate a new purchase shortly, so I am looking at some potential targets to be added to my portfolio. My desired portfolio allocation shows that I should look into REITs at the moment:

Realty Income (O)

First in the list is a company which is known by most dividend investors. It even presents itself as “The Monthly Dividend Company”.

About the company from Morningstar:

Realty Income is the largest triple-net REIT in the United States, with more than 12,200 properties that mainly house retail tenants. The company describes itself as “The Monthly Dividend Company,” and its line of business and operating metrics make its dividend one of the most stable sources of income for investors. Even though over 80% of Realty Income’s tenants are in retail, most are focused on defensive segments, with characteristics such as being service-oriented, naturally protected against e-commerce pressures, or resistant to economic downturns. Additionally, the triple-net lease structure places the burden of all operational risk and cost on the tenant and requires the tenant to make capital expenditures to maintain the property rather than the landlord. These leases are often long term, frequently 15 years with additional extension options, which provides Realty Income a steady stream of rental income. Coverage ratios are also very high, so tenants are healthy and unlikely to request rent concessions, even during downturns. The steady, stable stream of revenue has allowed Realty Income to be one of only two REITs to be members of the S&P High-Yield Dividend Aristocrats Index and have a credit rating of A- or better. This makes Realty Income one of the most dependable investments for income-oriented investors.

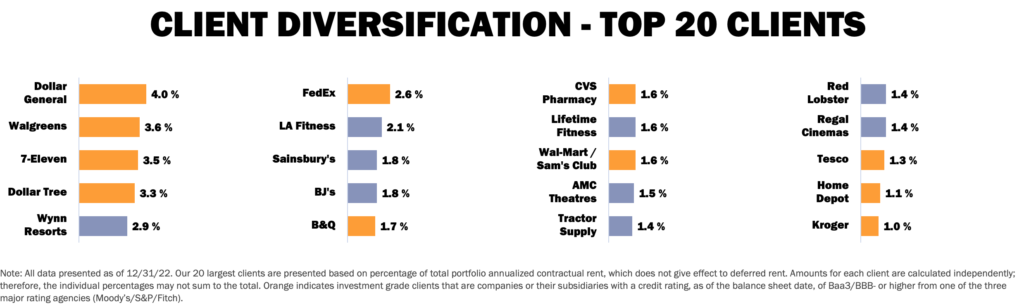

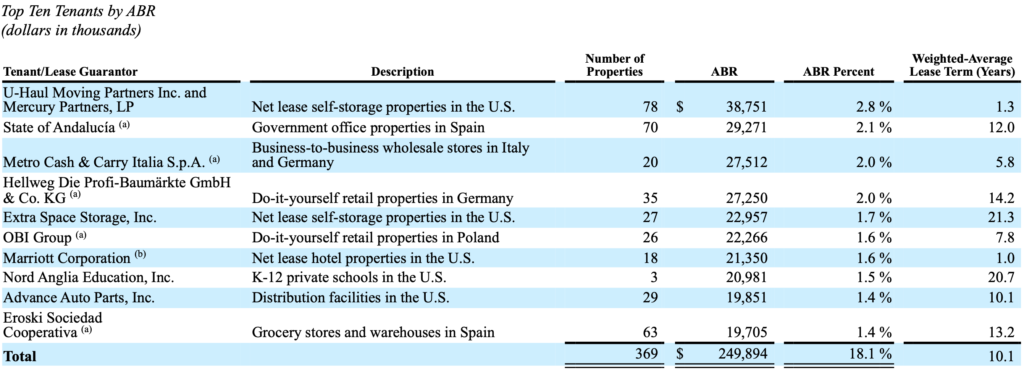

It’s a solid company with great diversification. Here’s a look at its 20 biggest tenants:

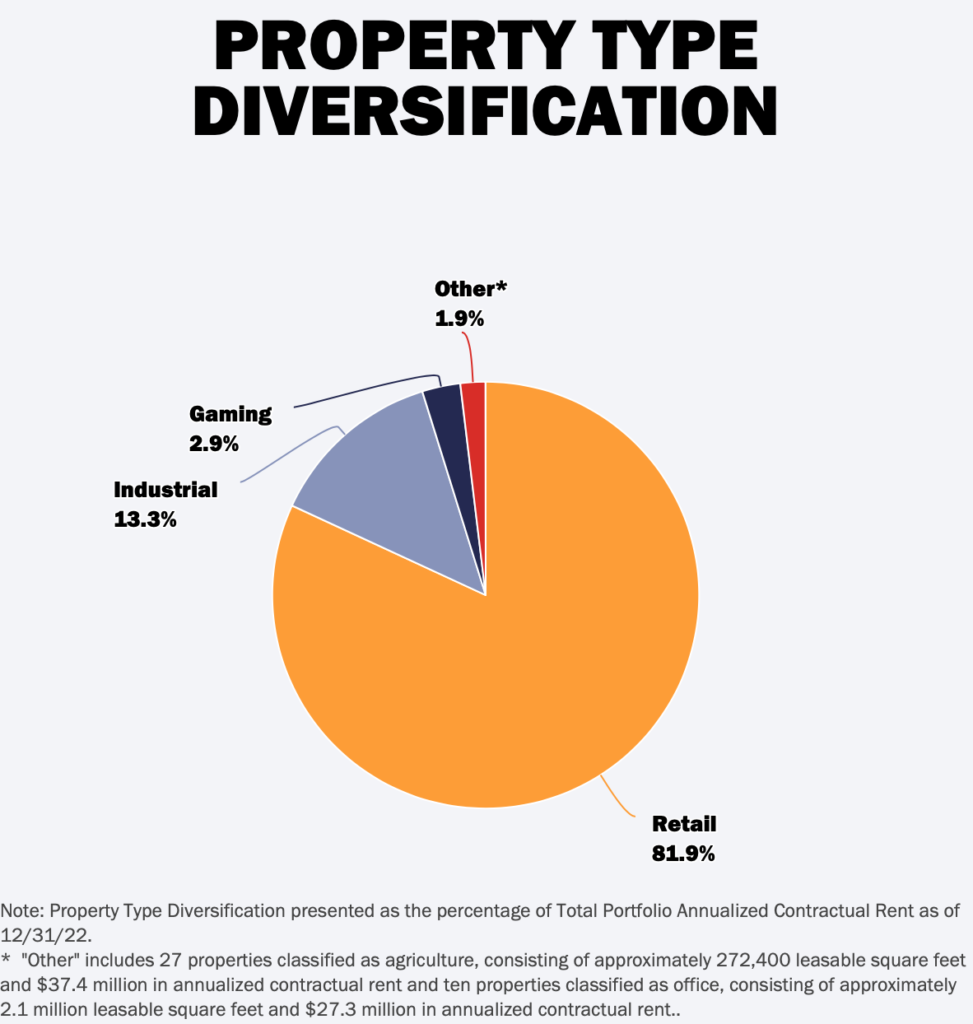

In terms of Property Type diversification:

I also gathered a list of some metrics that look important to me when looking at REITs:

- Current price – $61.38;

- FFO Payout Ratio (forward) – 76.19%;

- Net Debt/EBITDA – 6.22;

- EBITDA/Net Interest Expenses – 6.39;

- Net Interest Expenses/Net Operating Income – 35.73%;

- Debt/Total Real Estate Assets – 48.06%;

- Dividend Yield – 4.97%;

- Average 4-yr yield – 4.23%;

- Dividend growth streak – 26 years.

I can see a few positive things about the company:

- Company is a reliable dividend payer and has grown their dividend for 26 years in a row;

- Its current Dividend yield is bigger than its 4-yr average;

- Company has acquired substantial amount of properties in recent year ($9B in 2022) which is growing their Funds From Operations (FFO);

- Property-level occupancy stood at 99% in 2022.

There are some drawbacks as well, though:

- Relaty Income is predicting its AFFO to grow at ˜1.5% during 2023 which is much lower than inflation rate;

- Rent for company’s tenants is growing at a slow pace of ˜1%;

- Quite high level of debt;

- Realty Income is mainly growing their FFO from acquisitions, and it is getting harder to do it lately for a couple reasons: 1) Interest rates are much higher than before and company needs to pay more to borrow (it recently issued bonds at ˜5% interest); 2) Current value of company’s properties is much higher than before, so it would need to buy more properties to achieve the same growth in percentage points.

In short, I see Realty Income as a very stable source of dividend income but growth capabilities seem somewhat limited.

W.P. Carey (WPC)

Next in the list is another REIT, liked by dividend investors. Shortly about W.P. Carey from company’s Morningstar:

W.P. Carey Inc is a real estate investment trust principally involved in the ownership of properties located in the U.S., Western Europe, and Northern Europe. W.P. Carey organizes its operations into Real Estate and Investment Management segments. The vast majority of the company’s income is derived from its Real Estate division in the form of lease revenue from long-term agreements with companies. W.P. Carey’s real estate portfolio is primarily comprised of single-tenant office, industrial, warehouse, and retail facilities located around the world. most of the company’s revenue comes from properties in the USA. The company’s Investment Management unit generates revenue from providing real estate advisory and portfolio management services to other REITs.

Compared to Realty Income (which is focused on Retail), W.P. Carey seems to be more diversified. As it says in its latest annual report, they “invest in high-quality single tenant industrial, warehouse, office, retail, and self-storage (net lease) properties subject to long-term leases with built-in rent escalators“.

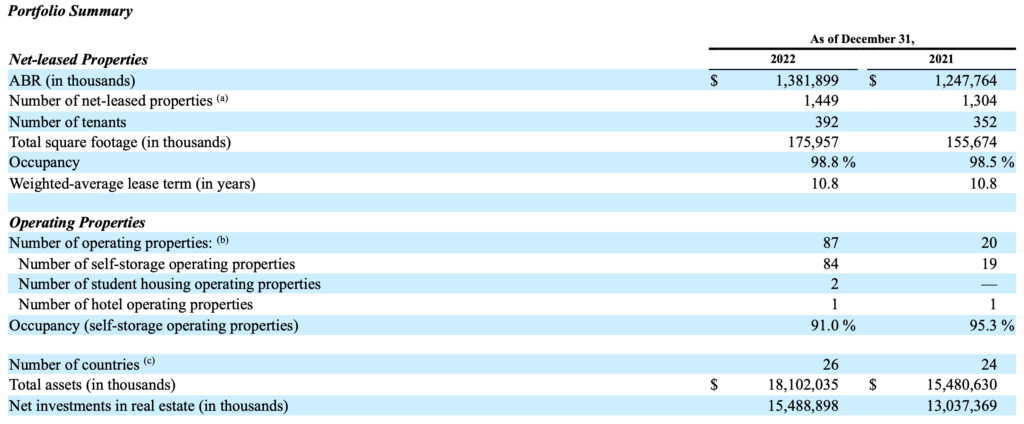

From the same report, here’s an overview of their portfolio:

I like to see the diversification by country and the fact that average lease term is almost 11 years.

And here’s a list of their top 10 tenants:

Let’s review the same metrics as we did for Realty Income:

- Current price – $78.31;

- FFO Payout Ratio (forward) – 81.34%;

- Net Debt/EBITDA – 6.14;

- EBITDA/Net Interest Expenses – 6.01;

- Net Interest Expenses/Net Operating Income – 29.00%;

- Debt/Total Real Estate Assets – 62.07%;

- Dividend Yield – 5.45%;

- Average 4-yr yield – 5.50%;

- Dividend growth streak – 9 years.

To summarize, a few things I like about the company:

- Occupany rate of 98.8% shows high level of consistency;

- 55% of W.P. Carey’s leases are CPI-linked, which means that they can raise rents in touch with Consumer Price Index changes;

- High diversification both geographically and industry-wise.

Some drawbacks that I can see:

- Just like other REITs, it will suffer from growing interest rates, as it need to borrow money;

- Even though the dividend yield is high, it’s slightly lower than its average yield in recent years;

- Quite high level of debt;

- Dividend growth is very slow (Dividend Growth Rate 5Y (CAGR) stands at 1.13%).

Prologis (PLD)

Next in the list is another company which was in my portfolio before. It’s a REIT in Industrial REITs industry. Shortly about the company from Morningstar:

Prologis acquires, develops, owns, and operates industrial facilities that are strategically located in markets characterized by large population densities, growing consumption, and high barriers to entry, typically near large labor pools and extensive transportation infrastructure. The firm’s strategy is to leverage the organizational scale of its 1 billion square foot portfolio to provide a single point of contact to address the logistical needs of its multimarket clientele. The firm’s strategically located global land bank has the potential to support the lucrative development of approximately $26 billion of new industrial projects in upcoming years.

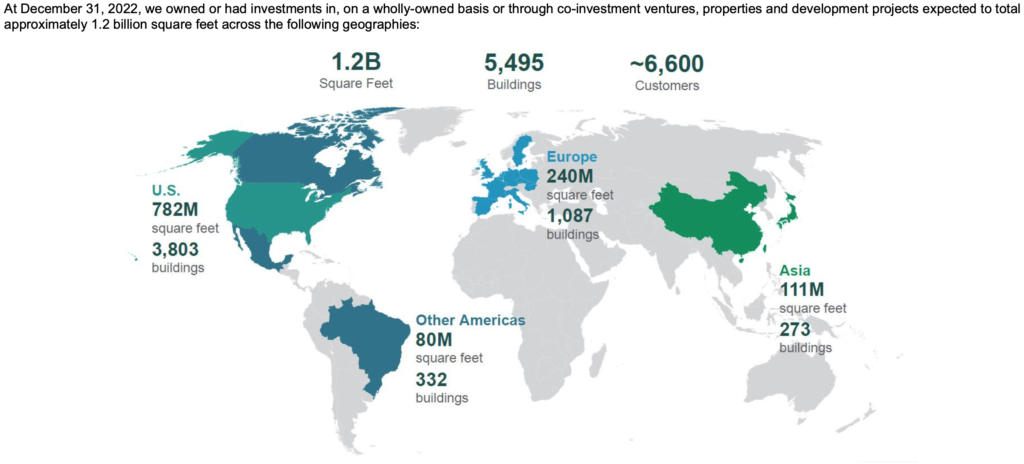

Overview of company’s global portfolio:

A notable event happened for the company last year. It acquired Duke Realty company and as a result added 494 industrial operating properties, aggregating 144 million square feet to its portfolio. The acquisition was paid in newly issued Prologis shares and cost ˜$23B. As a result, it adds additional revenue for the company but there was also a dilution of shares for existing shareholders.

Let’s review the same metrics as we did for the previous companies:

- Current price – $116.98;

- FFO Payout Ratio (forward) – 65.89%;

- Net Debt/EBITDA – 5.50;

- EBITDA/Net Interest Expenses – 14.25;

- Net Interest Expenses/Net Operating Income – 11.92%;

- Debt/Total Real Estate Assets – 33.38%;

- Dividend Yield – 2.97%;

- Average 4-yr yield – 2.26%;

- Dividend growth streak – 9 years.

Some things that I like about the company:

- I like Industrial REITs and can see more potential in them compared to Retail or Residential REITs at the moment;

- Even though the dividend yield of 2.97% is lowest from other REITs in this watchlist, it’s above company’s 4-yr average yield;

- Company is well-positioned to cover its debt in case of some troubles.

Drawbacks of Prologis:

- Quite low starting dividend yield;

- Just like for other REITs, growing interest rates are making it more expensive for company to borrow.

NewLake Capital Partners (NLCP)

Finally, mainly for fun, I’m including a REIT which is focused on cannabis industry. Shortly about the company from Morningstar:

NewLake Capital Partners Inc is an internally-managed real estate investment trust that provides real estate capital to state-licensed cannabis operators through sale-leaseback transactions, third-party purchases and funding for build-to-suit projects.

It’s an interesting REIT, to say the least. It caught my attention a couple months ago and while preparing this watchlist I decided to check the price of NLCP. I noticed that it nosedived during the last month:

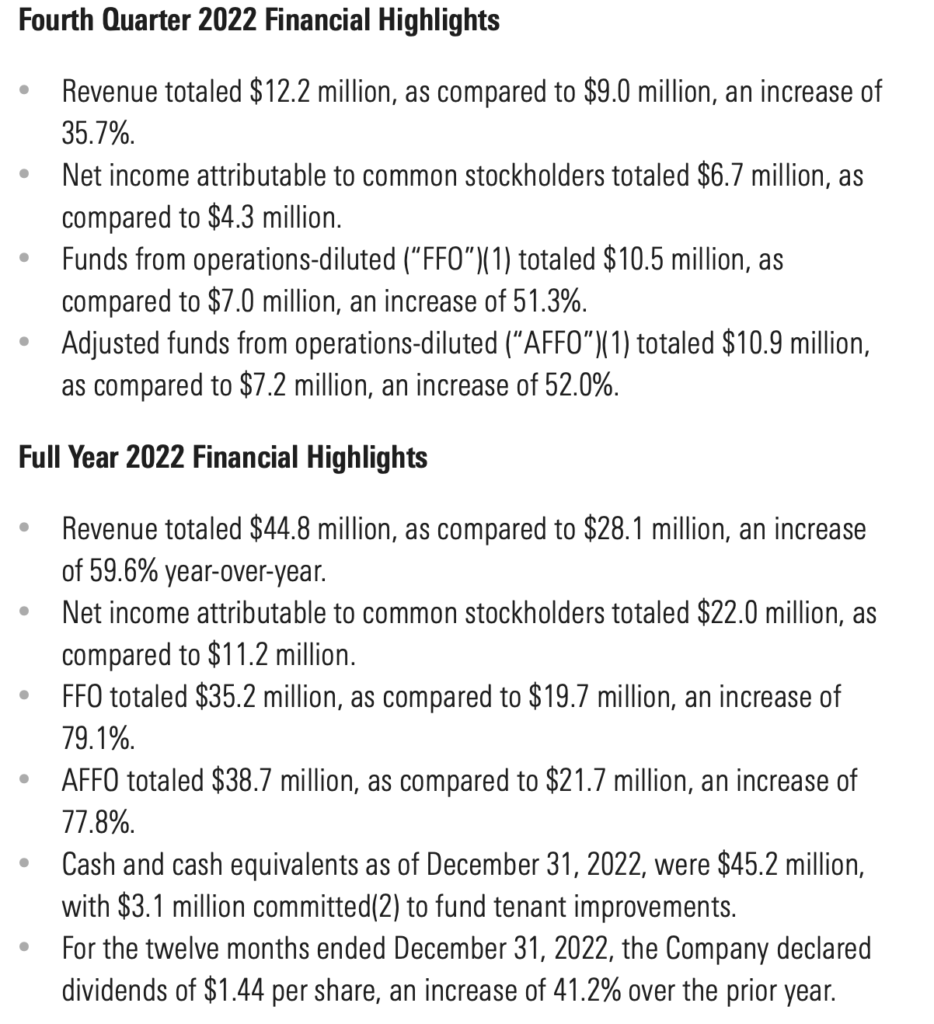

While looking at the latest earnings release, it was hard to see what could have caused this huge drop in price, as the numbers are looking good:

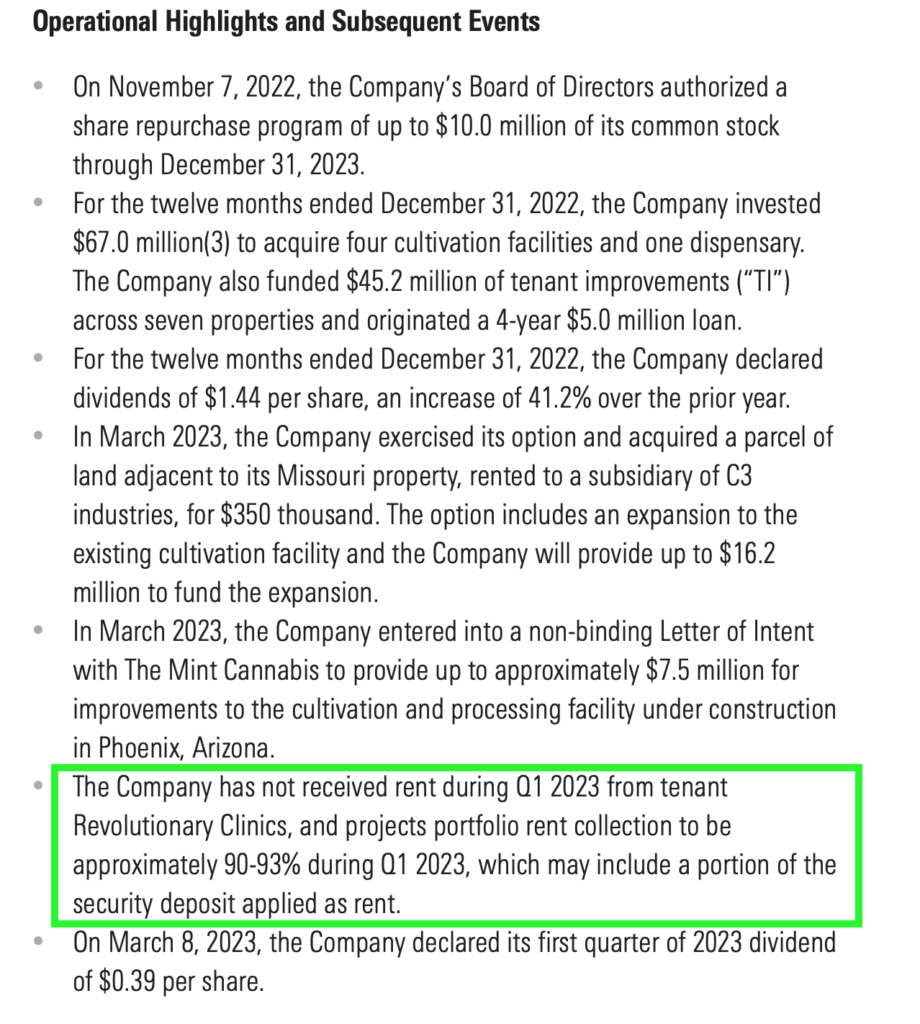

However, the culprit was lying in one sentence, following the highlights from last year:

It turns out that one of company’s tenants is no longer able to pay rent and company is expecting to collect only 90-93% of rent in Q1 2023. Given that they are including a portion of security deposit into this count, I assume that the real amount would be even lower.

I am not an expert of the industry, so it’s not clear how hard it will be for the company to replace tenant if Revolutionary Clinics appears to be insolvent. Also, it could be that more tenants will follow suit, as it seems that the cannabis industry is not living through its greatest times.

Let’s run the company through the same metrics as we did for previous REITs:

- Current price – $13.38;

- FFO Payout Ratio (forward) – 87.59%;

- Net Debt/EBITDA – N/A (company has more cash and cash equivalents than debt);

- EBITDA/Net Interest Expenses – 177.00;

- Net Interest Expenses/Net Operating Income – 0.88%;

- Debt/Total Real Estate Assets – 0.79%;

- Dividend Yield – 10.76%;

- Average 4-yr yield – 4.46%;

- Dividend growth streak – 1 year.

Some positive things about the company:

- Huge dividend yield. Most probably, it’s not sustainable, but I have to mention it;

- Virtually no debt. Even if the matters turn south significantly from here, I don’t think that the company would go to zero. It has real estate assets and no debt, so I think that the way down is somewhat limited. I would get interested, if the Market Cap of NLCP would drop below $250M (currently stands at $286M);

- Potential for big growth in case the things turn out to be less negative as currently expected.

Of course, there are drawbacks as well:

- Since it is a small company, there is not much diversification. Inability to pay by one tenant is able to wipe out 10% of rent collection for the company;

- Industry it is operating in is in a bad shape, especially with growing interest rates. Even though the company itself doesn’t have any debt, its tenants do have it and are struggling to pay it;

- Company is highly dependant on legislation changes for cannabis industry.

In short, it’s the least likely candidate to enter my portfolio, as I am not willing to start my portfolio by such volatile stocks. However, I am planning to look into the company in the future and see where it goes from here.

Summary

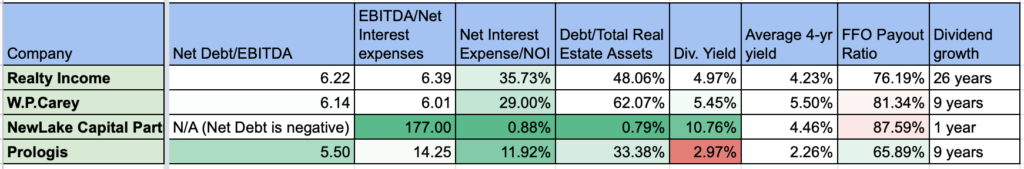

Here’s a short comparison table about the companies discussed in this watchlist. All the calculations are mine, based on data from Seeking Alpha, so please make sure to do your own diligence:

Looking at the list, I am mainly leaning towards Realty Income (O) or W.P.Carey (WPC). I have a few more companies in mind but it already took a while to dig a little deeper into those 4 companies, so I’ll leave additional research for another day 🙂

What do you think about the REITs discussed? Do you own any of them in your portfolio? What would be your go-to REIT at the moment? I would love to read your comments!