Similar to last month, I haven’t made a big purchase this month. Instead, I made 4 small buys because they were commission-free. Let’s see what I bought this month.

Buy #1 – Baltic Horizon Fund (NHCBHFFT)

First up is a Baltic REIT. Shortly about the fund from company’s website:

Baltic Horizon currently holds a portfolio of 15 commercial properties worth over 371 million EUR (as of 31.12.2019). All properties are located in the capital cities of Baltics: 5 properties in Tallinn, 5 properties in Riga and 5 properties in Vilnius. Total NLA of the portfolio is approx. 153,350 m2.

Property portfolio is estimated to generate about 23 mln EUR NOI (net operating income) in the current year on as-is basis, which implies a portfolio yield of over 7%. Total vacancy of the portfolio is under 2%. Portfolio WAULT (weighted average un-expired lease term) is approx. 4 years.

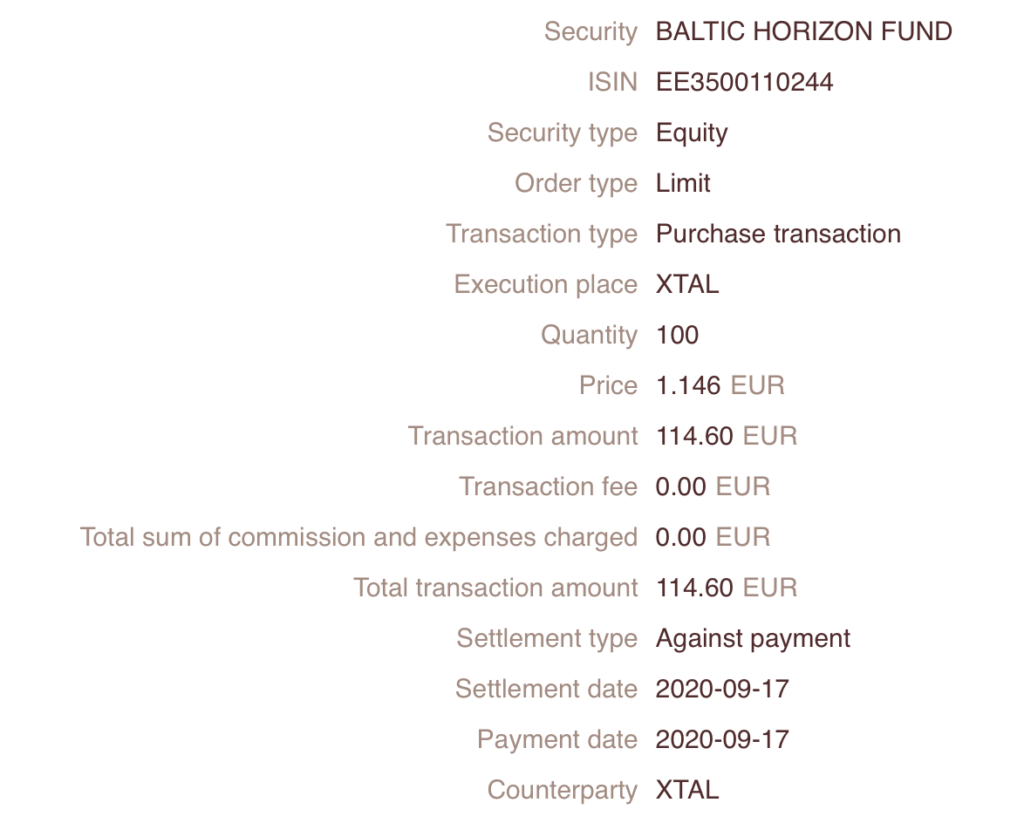

On the 15th of September, I bought 100 units of the fund at €1.146/share for a total of €114.60:

I started my position back in August and am planning to slowly build it to come closer to my other portfolio positions. This purchase adds €5.1 to my forward annual dividend income if their income distribution doesn’t change.

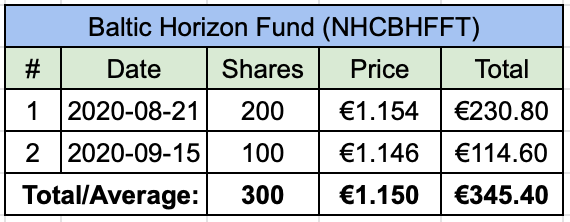

This is how my purchase history of Baltic Horizon Fund looks like:

Currently, I own 300 units of Baltic Horizon Fund.

Buy #2 – Slack (WORK)

Next, I purchased a few shares of a company that is in “PlayMoney” category of my portfolio. Shortly about the company from Morningstar:

Slack Technologies operates Slack, a software-as-a-service platform that brings together people, applications, and data. The platform is appropriate for all business types, from small and medium-size businesses to enterprise customers. The company was founded in 2009 as a game developer but later changed its focus and released its internally developed toolset, Slack, in 2013. It is headquartered in San Francisco.

Share price of Slack plunged by ~25% after their latest earnings release due to billings disappointment. I decided to take the opportunity and reduce my cost base.

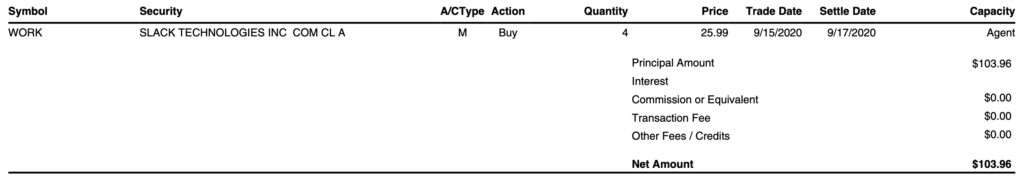

On the 15th of September, I bought 4 shares of Slack at $25.99/share for a total of $103.96:

Since Slack doesn’t pay a dividend and is not profitable yet, it is very different to my other portfolio holdings. I decided to keep a small part of my portfolio (up to 2%) for such companies. I like their product and I know that it is liked by IT personnel. Even though the company faces stiff competition from Microsoft, I think they still have some potential, so I’m willing to see how it plays out in the future.

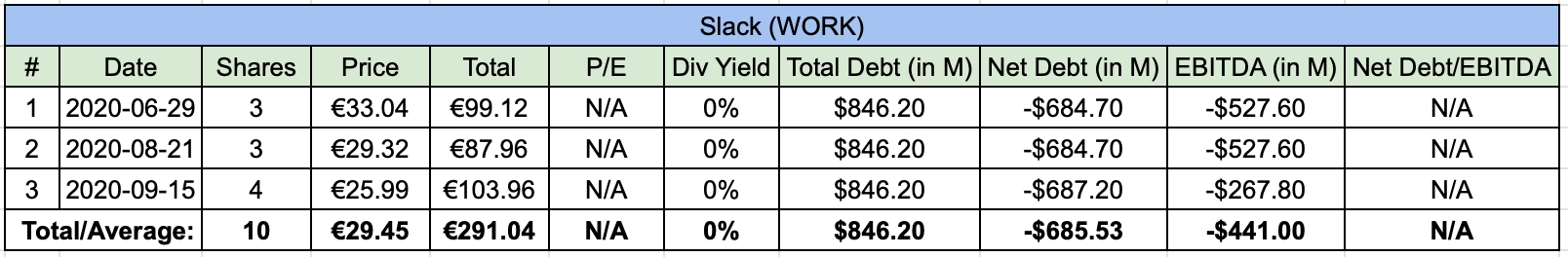

This is how my purchases of Slack over time look like:

After this purchase, I own 10 shares of Slack in my portfolio.

Buy #3 – Johnson & Johnson (JNJ)

My next buy was of a healthcare giant. I guess it needs no introduction but here is a short overview of the company from Morningstar:

Johnson & Johnson is the world’s largest and most diverse healthcare firm. Three divisions make up the firm: pharmaceutical, medical devices and diagnostics, and consumer. The drug and device groups represent close to 80% of sales and drive the majority of cash flows for the firm. The drug division focuses on the following therapeutic areas: immunology, oncology, neurology, pulmonary, cardiology, and metabolic diseases. The device segment focuses on orthopedics, surgery tools, vision care, and a few smaller areas. The last segment of consumer focuses on baby care, beauty, oral care, over-the-counter drugs, and women’s health. Geographically, just over half of total revenue is generated in the United States.

On my most recent portfolio overview I indicated Healthcare sector as one of the areas I would like to increase in my portfolio. JNJ is one of the companies I am slowly building in my portfolio when I have free trades.

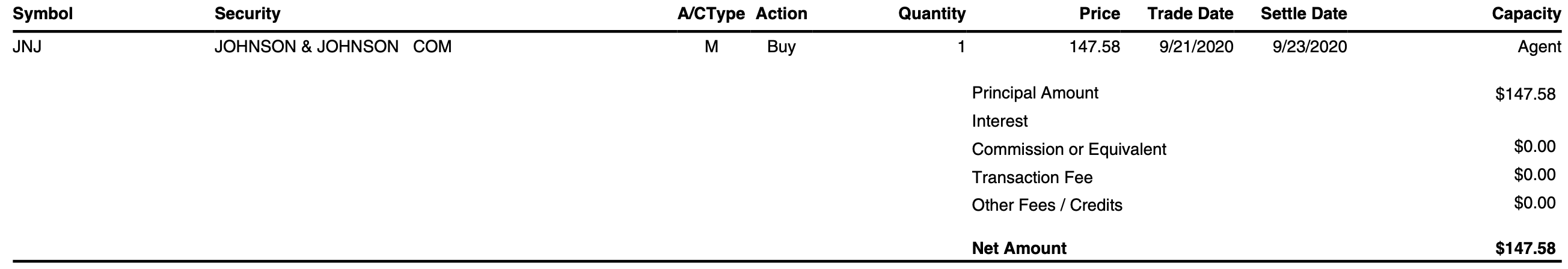

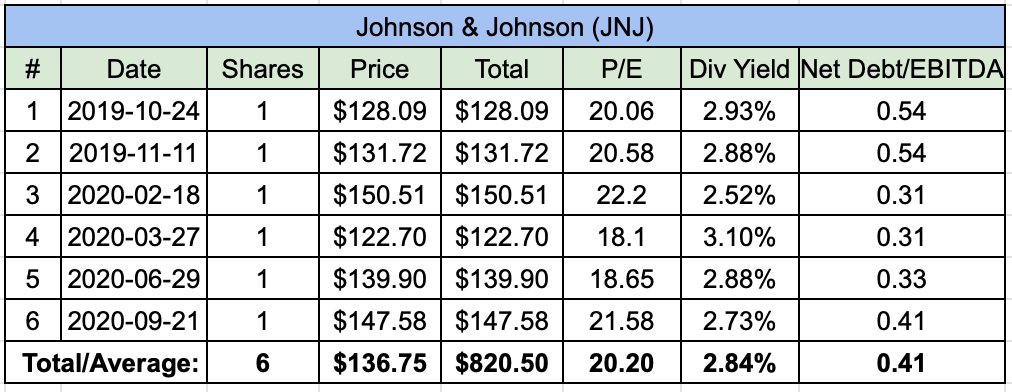

So, on the 21st of September, I bought 1 share of JNJ for $147.58:

This purchase adds $3.43 to my net forward annual dividend income.

That’s how my history of JNJ purchases looks like:

I now own 6 shares of Johnson & Johnson.

Buy #4 – Altria Group (MO)

Finally, I added to a sin stock in my portfolio. It represents the Consumer Defensive sector which I am also targeting after my latest portfolio overview.

Shortly about the company from Morningstar:

Altria comprises Philip Morris USA, U.S. Smokeless Tobacco, John Middleton, Ste. Michelle Wine Estates, Nu Mark, and Philip Morris Capital. It holds a 10.2% interest in the world’s largest brewer, Anheuser-Busch InBev. Through its tobacco subsidiaries, Altria holds the leading position in cigarettes and smokeless tobacco in the United States and the number-two spot in machine-made cigars. The company’s Marlboro brand is the leading cigarette brand in the U.S. with a 40% share.

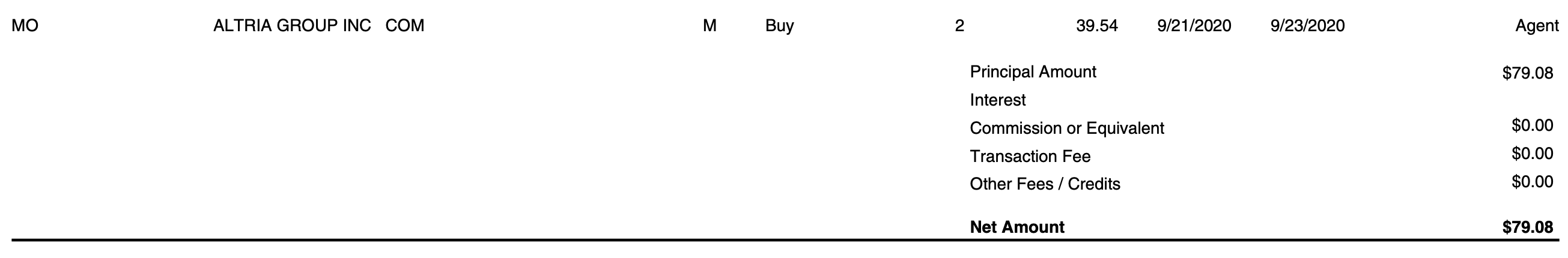

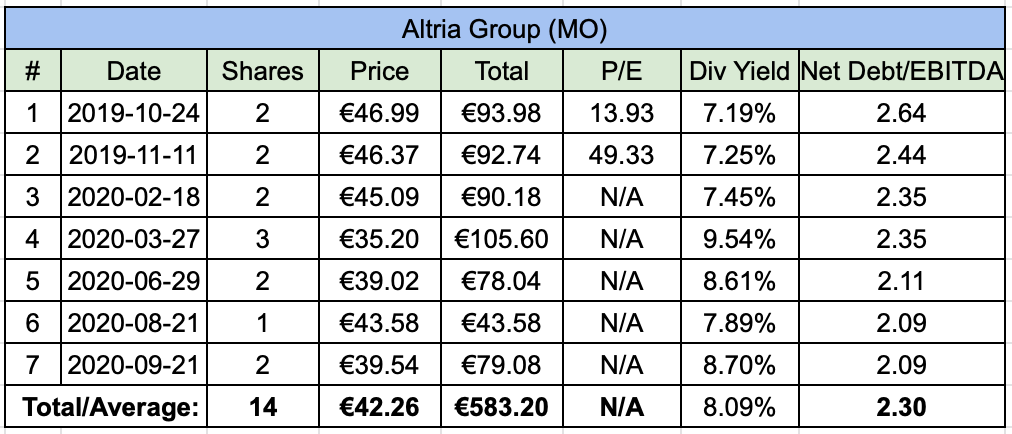

On the 21st of September, I bought 2 shares of Altria Group at $39.54/share for a total of $79.08:

This purchase adds $5.84 to my net forward annual dividend income.

That’s how my purchase history of Altria Group looks like:

After the latest purchase, I now own 14 shares of Altria Group.

Summary

In total, I deployed ~€400 (€114 + $330) of cash to make the purchases. It adds ~€12 (€5.1 + $9.27) to my net forward annual dividend income. I also slightly increased exposure to the sectors I wanted to increase in my portfolio.

What have you been buying lately? Do you have any targets at the moment? I would love to hear your thoughts!

Nice purchases. BH is my largest position. Own JNJ and MO would like to own some more of these. Will you participate in Ignitis IPO? I am 🙂 Altough low yield, but its Utility and renewables 😉 you will not find such cheap.

Thanks for the comment P2035!

Funny that you asked, I just applied for participation in the IPO approximately an hour ago 😀 And the yield doesn’t seem too low, I think it will be higher than my portfolio average 🙂

Hey BI, small buys also constitutes progress. Every step you take forward is a step towards your future freedom 🙂

I just posted my Q2 and Q3 buys to keep myself accountable as well. Lets keep on grinding!

Thanks for the comment Mr. Robot! I couldn’t agree more, taking small steps is better than not taking any steps ar all 😀

Going to see what you bought recently 🙂