The first month of autumn is in the books. It was full of activities in our family. Our daughter started going to kindergarten, had her baptism and we celebrated her second birthday. Both me and my wife have been working from home for the whole month and it’s quite convenient when you get used to it. Especially, when our daughter is in kindergarten.

Now let’s get to the main topic of this post – passive income for the month of September.

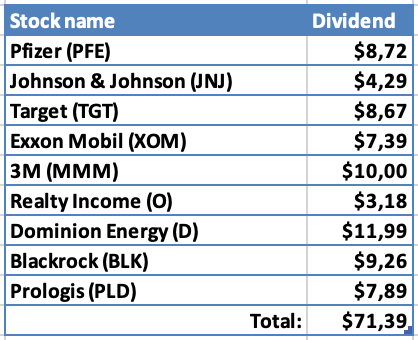

Dividend Income

Last month of the quarter tends to be the most favourite month for companies to pay dividends. My portfolio is no exception, with 9 companies paying in September:

Two companies paid at least $10 this month. The biggest contributor was the Utility company Dominion Energy (D), followed by Blackrock (BLK).

As always, let’s see what part of expenses of different categories in my budget the dividends could cover if I decided to spend them:

- $8.72 from Pfizer and $4.29 from Johnson & Johnson would cover 14.8% of our expenses in Health category for the last 3 months;

- $8.67 form Target would cover 0.6% of our expenses on Food for the last 3 months;

- $7.39 from Exxon Mobil would cover 5.7% of our Car & Transportation expenses for the last 3 months;

- $10.00 from 3M would cover 0.5% of what we spent on Baby related expenses (mainly Daycare) during the last 3 months;

- $3.18 from Realty Income and $7.89 from Prologis would cover 1.73% of our monthly Rent;

- $11.99 from Dominion Energy would cover 3.2% of our Utilities bills for the last 3 months;

- Finally, $9.26 from Blackrock could cover 43.6% of our expenses in Banking category for the last quarter.

There is long way to go for dividends to cover significant amount of our monthly expenses but performing this fun exercise gives me motivation to keep going.

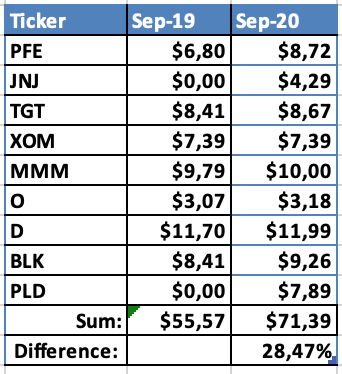

Year-on-Year Comparison

Let’s see what the difference year-on-year looks like:

Dividend income increased by 28% compared to last year, which is not bad. Most of the increase came from the new positions in Johnson & Johnson (JNJ) and Prologis (PLD).

The only company that paid the same dividend as last year was Exxon Mobil (XOM). It’s not a good time for oil companies, so I am happy that they at least did not cut it yet.

All other companies awarded me with slightly bigger dividends, compared to last year.

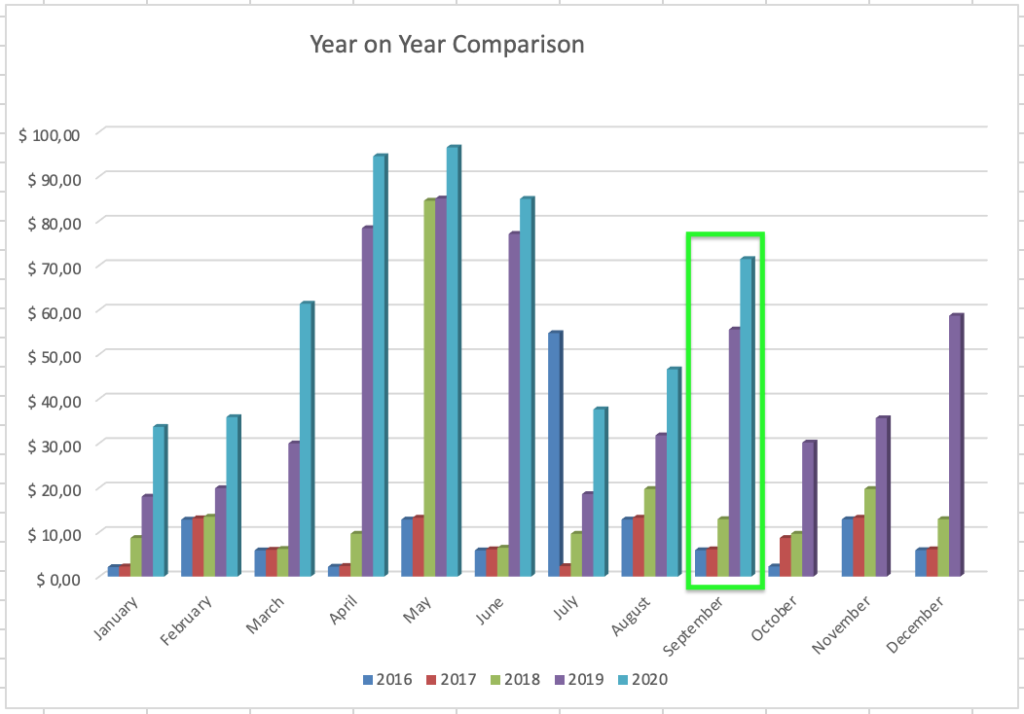

This is how my dividend income progress looks like since the beginning of 2016 when I started tracking it:

Purchases and Portfolio Contributions

This month I added €500 to my investment accounts.

Similar to last month, instead of making a big purchase, I made a few small buys of companies I already had in my portfolio:

- 100 units of Baltic Horizon Fund at €1.146/share for a total of €114.60;

- 4 shares of Slack (WORK) at $25.99/share for a total of $103.96;

- 1 share of Johnson & Johnson (JNJ) for $147.58;

- 2 shares of Altria Group (MO) at $39.54/share for a total of $79.08.

It adds ~€12 (€5.1 + $9.27) to my net forward annual dividend income. You may read more about the buys here.

Dividend Increases/Cuts

This month, one company announced a dividend increase:

Realty Income announced their regular quarterly dividend increase. It only adds a few cents to my annual dividend income but at least it is going to the right direction in this volatile environment.

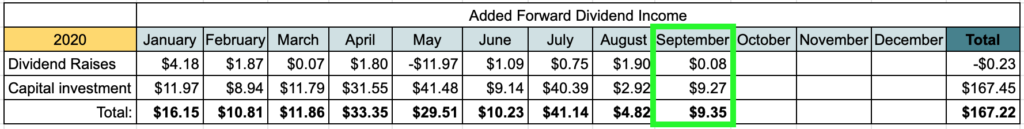

Changes in Projected Annual Dividend Income

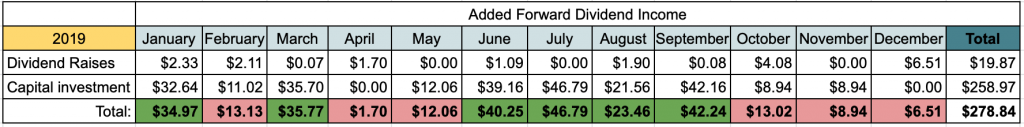

I am continuing the tradition from last year to track changes in Projected Annual Dividend Income. It is coming from two sources – Dividend raises/cuts and new investments.

Let’s see how forward dividend income changed during September:

September was again on the smaller side in terms of added forward dividend income. I only made small purchases and one of them was in a European company whose dividends I don’t rely on and therefore don’t put it on this table.

For comparison, I am also adding the table from previous year:

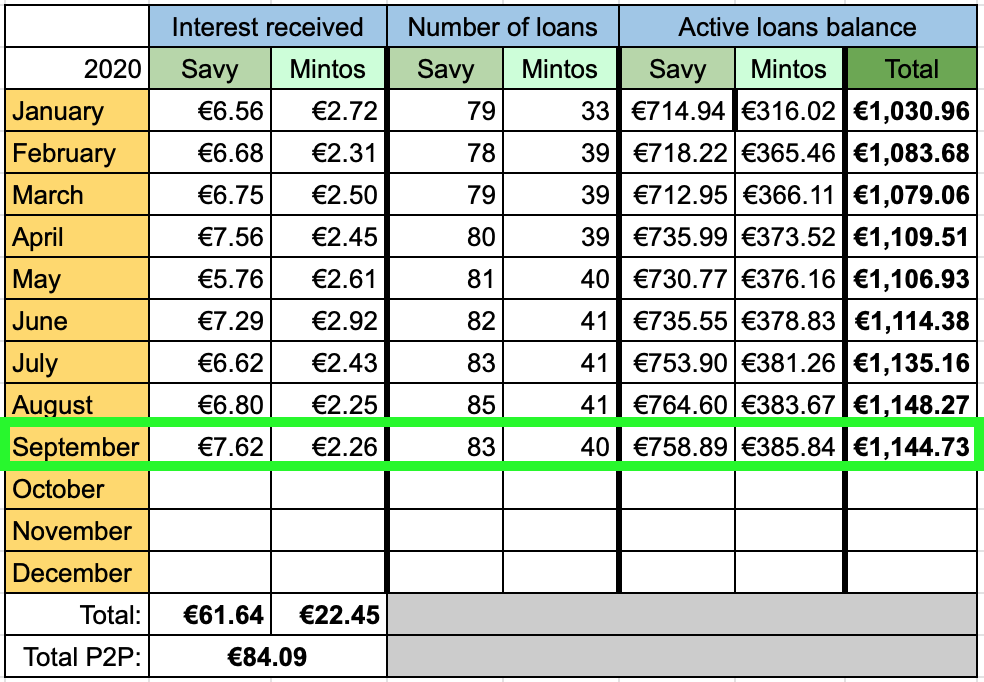

P2P Lending Income

Let’s see how much income was added from interest in P2P lending:

Interest from P2P lending added up to €9.88 which is slightly higher than in previous month.

P2P lending portfolio currently takes 4.42% of my portfolio which is close to my target of 4%. Even though the profit from this platform looks nice, I don’t want it to be a big part of my portfolio due to related risk it brings.

If you would like to sign up with Mintos and receive some cashback, feel free to use my referral link (I would also get a small commission).

Summary

In total (after converting to EUR) I received €70.81 from passive income during September. This brings the total for the year to €582.05. This is just 58% of my goal to receive €1000 in passive income during 2020. On the bright side, I already surpassed the total passive income I received last year (€573), so I can’t complain.

How was your September? Is the weather still nice where you are? Are you on track to reach your goals this year? Thanks for reading and I would love to hear from you! 🙂

Great report BI. Like you, I like the end of quarter months and September is no different. I really like how you break dividends down by companies to see what percentage of their expenses the dividends would cover. I do a similar thing but instead of breaking it down by companies, I just use the overall dividends and overall expenses and compare, checking them off my list as I go.

It’s always nice to see that you’re making income from multiple sources, including P2P lending. Good luck in the 4th Quarter. Let’s finish the year strong!

Thanks for the comment DP!

I am thinking if I should change how I compare my dividend income with expenses. For now, I decided to go with approach to assign individual companies to different categories of portfolio. But I like your approach as well. It would be nice to cross out some regular expenses that could be covered by dividends!

Good luck to you too!

Congratulations on a successful third quarter BI!

Income from portfolios is growing and that’s why we do it.

Comparing passive income against total expanses can be a bit depressing at the beginning 🙂

Good luck.

Thanks for the comment, LoI!

We are here for the long term, so it’s natural that the numbers are small compared to expenses. I hope for them to become bigger as the time goes by 🙂

Nice report and great growth rate compared to last year! Also good to see you keep making buys consistently, the only way to keep moving forward in the long run.

Thanks a lot for the encouragement, Mr. Robot!

Doing what I can with those buys, when I can 🙂

Congrats on passing last year’s dividend total already, BI. The next 3 months will be icing on the dividend cake.

So close to having 10 dividend payers for the month… next year for sure.

Your YoY comparison chart is looking good. Each month of 2020 has provided good growth. Your monthly contributions are terrific and will continue to push your monthly dividend totals higher.

BLK had a good run up in price over the past month and change. Hopefully, it will stay over $600 and not look back.

Sounds like your daughter had a very busy month. Lots of exciting things happening in her life, and thus yours, too. Are you getting any time to train these days?

Thanks a lot for the comment, ED!

As a matter of fact, I find time for training. When our daughter is in kindergarten and I am working from home, I use my lunch breaks to go for a run, so that’s nice. I’m also doing a challenge of doing 10-minute workouts each day this month. I did a workout for day 25 today, so it’s looking good so far 🙂

As with investments front, I will nedd to step back from investments for some time due to some personal reasons shortly, but it’s just a temporary setback. I know that I will be back and the investments I made will be working in the background in the meanwhile.

Thanks again for the encouragement! I should visit your blog more frequently. I am a little detached from this lately but yours is one of the first to visit when I have time 🙂