The first month of summer is in the books. The weather was pretty good, so we spent a good amount of time outside. Buying bikes and a saddle for our daughter was a good decision, as we can reach the city centre easily and don’t need to pay for parking. Our little daughter likes riding as well. We also had a short vacation in the seaside with some friends which was fun. As a result, I didn’t spend much time following financial news or working on this blog. I guess it’s summer time for this part of my life as well.

Nevertheless, I would not miss the main article of the month which summarizes all the passive income we received. Let’s see what our portfolio brought while we were having fun.

Dividend Income

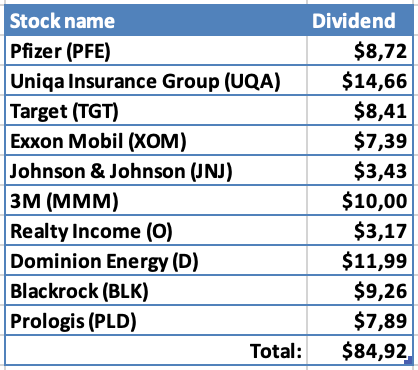

This month, 10 companies paid dividend to me:

Almost $85 received is a substantial amount for my portfolio. I had one annual payer – Uniqa Insurance Group. It was the biggest contributor, even though they reduced their dividend by 66%, compared to last year. I also had quite a few payers, since it was the last month of a quarter.

As always, let’s see what part of expenses of different categories in my budget the dividends could cover if I decided to spend them:

- $8.72 from Pfizer and $3.43 from Johnson & Johnson would cover 37.1% of our expenses in Health category for the last 3 months;

- $14.66 from Uniqa Insurance Group would cover 22.1% of our complimentary annual car insurance;

- $8.41 form Target would cover 0.5% of our expenses on Food for the last 3 months;

- $7.39 from Exxon Mobil would cover 1.4% of our Car & Transportation expenses for the last 3 months;

- $10.00 from 3M would cover 0.5% of what we spent on Baby related expenses (mainly Daycare) during the last 3 months;

- $3.16 from Realty Income and $7.89 from Prologis would cover 1.63% of our monthly Rent;

- $11.99 from Dominion Energy would cover 2.2% of our Utilities bills for the last 3 months;

- Finally, $9.26 from Blackrock could cover 43% of our expenses in Banking category for the last quarter.

There is long way to go for dividends to cover significant amount of our monthly expenses but performing this fun exercise gives me motivation to keep going.

Year-on-Year Comparison

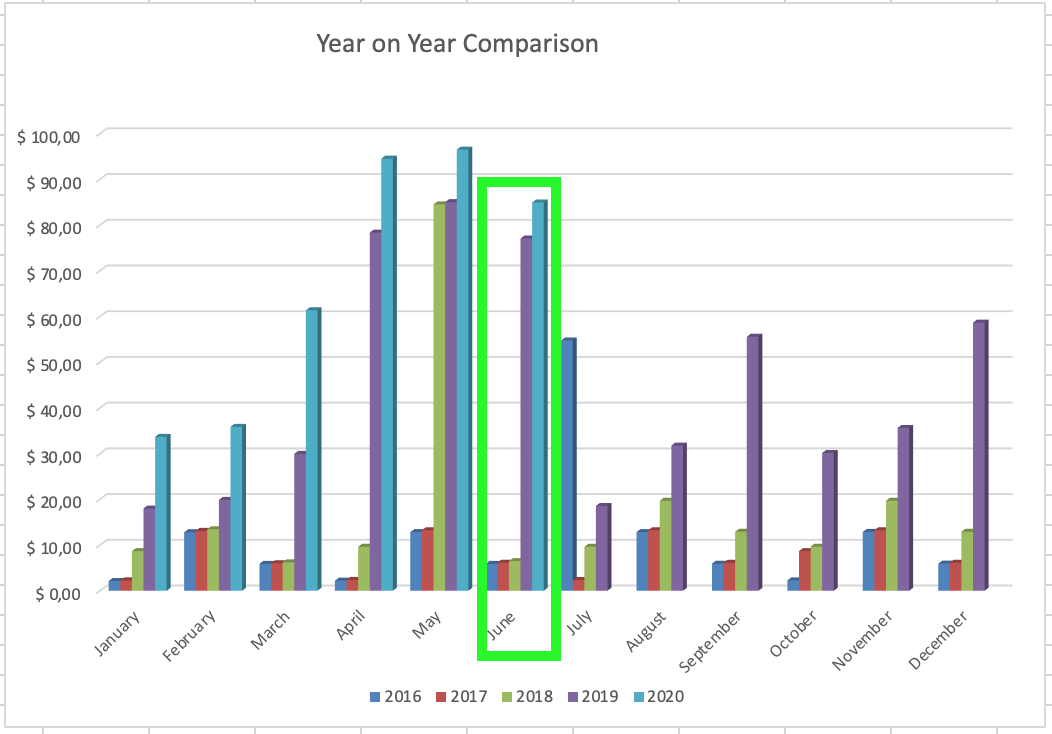

Let’s see how dividend income this June compares to the June a year before:

Actually, I thought that this will be a month when I receive less dividends compared to last year (due to smaller dividend from UQA). However, I forgot about Prologis which paid on the last day of the month and saved the streak 🙂

This is how my dividend income progress looks like since the beginning of 2016 when I started tracking it:

Purchases and Portfolio Contributions

This month I added €500 to my investment accounts.

I didn’t have enough funds for a regular size purchase, so instead I used my free Revolut trades and made three small purchases:

- 1 share of Johnson & Johnson (JNJ) for $139.90;

- 2 shares of Altria Group (MO) at $39.02/share for a total of $78.02;

- 3 shares of Slack Technologies (WORK) at $33.04/share for a total of $93.12.

In total, I invested $310 and added $9.14 to my net forward annual dividend income.

You may read more about these purchases here.

Dividend Increases

This month, two companies announced dividend increases:

Realty Income keeps raising their dividend by a tiny margin every last month of a quarter. They were joined by Target, which increases their dividend by 3% this time.

Both increases are in line with what happened in June last year.

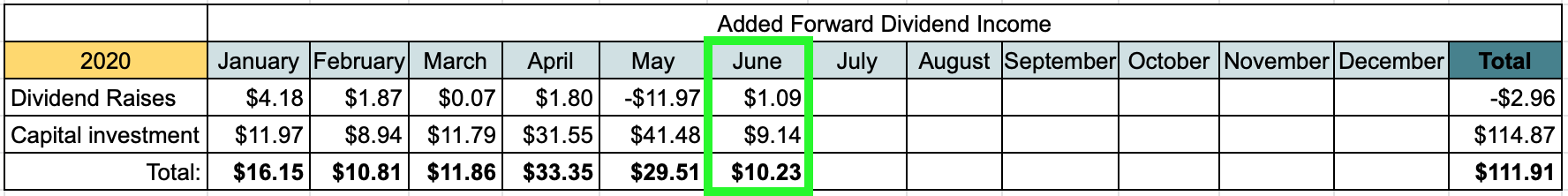

Changes in Projected Annual Dividend Income

I am continuing the tradition from last year to track changes in Projected Annual Dividend Income. It is coming from two sources – Dividend raises/cuts and new investments.

Let’s see how forward dividend income (from US companies) changed during June:

Unfortunately, June saw the smallest gain in PADI so far this year. I only had small purchases and the dividend increases were not big. However, it’s still a small step to the right direction.

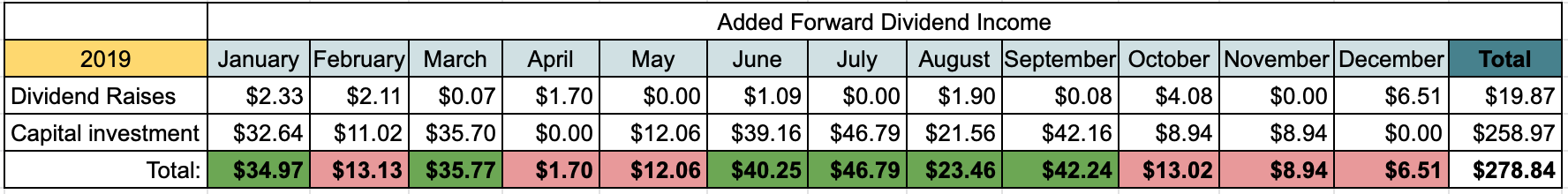

For comparison, I am also adding the table from previous year:

P2P Lending Income

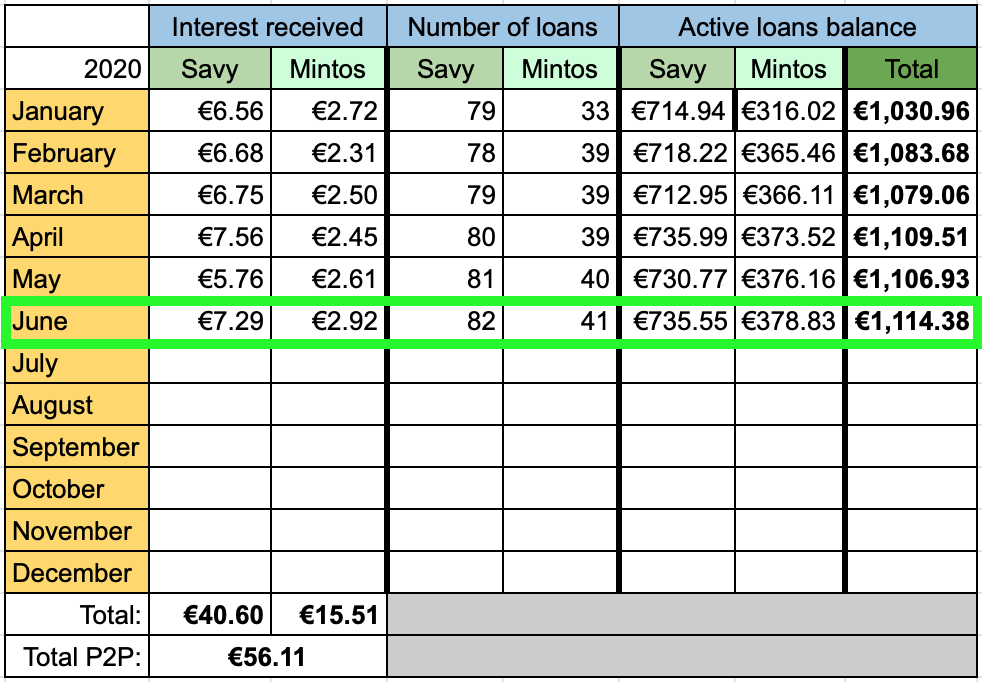

Let’s see how much income was added from interest in P2P lending:

Interest from P2P lending added up to €10.21 this month. It’s back above the €10 mark.

P2P loans portfolio takes 4.61% of my overall portfolio. It’s close to my target of 5%, so I just keep it as it is for now. Loans portfolio is slowly growing just from the interest received.

If you would like to sign up with Mintos and receive some cashback, feel free to use my referral link (I would also get a small commission).

Summary

In total (after converting to EUR), I received €84.84 from passive income during June. This brings the total for 2020 so far to €421.91 which is 42% of my goal to receive €1000 from passive income this year. It seems that I will miss the goal by a big margin. Anyway, I am not disappointed and will do my best to come as close to the goal as possible.

How was your month? Are you enjoying the summer? Have you hit any records? I would love to hear from you and thanks for visiting! 🙂

Hey BI, don’t worry about the blog. Enjoy your summer and holiday(s). We’ll be here following you when you get back 🙂

You are inching towards €100 a month my friend, how amazing is that! Keep up the grind and you’ll be there in no time!

Thanks a lot Mr. Robot! I think I will need to wait for next year to reach the €100 mark but I will definitely get there one day 🙂

Enjoy your summer as well!

Hi BI, Congratulations on exceeding the income of 2019. Next year the hundred will just fall!

Thanks a lot LoI! Not sure if this is going to happen in June but I am pretty sure that I will hit €100 at one of the months.

Hi BI, your new dividend payers came through and made up the lost dividend ground from UQA… keeping your dividend growth streak alive. I love to see that. You had some fairly even payouts among your list of payers, so that’s nice to see as well.

It’s been tough sledding this year, for sure. I, too, am behind pace with respect to reaching my dividend portfolio goals for the year. However, like you, I’ll strive to get as close as I can. Still, we are making forward progress, so nothing to be sad about there, right?.

Sounds like you are having an enjoyable summer. Get out there and enjoy the sun, as the cold and snow will return before you know it. Take care.

Thanks a lot, ED!

The year is tougher compared to a year ago, but we are still moving to the right direction 🙂

Let’s enjoy the summer while we can, even though I don’t hate winter either. At least, I tend to spend more time on blogs when the weather is cold 🙂

Take care!