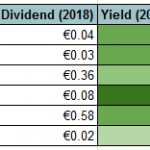

The most important thing at my current portfolio phase is to save part of my income and invest it to attractive stocks. I don’t believe in get-rich-quick schemes, so I keep saving every month and slowly build portfolio of companies that pay dividend. I hope that one day it will be able to cover someRead More