It’s been a while since I posted a watchlist. The market was firing all cylinders lately and it is getting harder to find nice targets. However, I think it’s important to keep investing and pay less attention to general market cycles. It’s too hard to predict what turn it is going to take, so I just invest when I can.

Let me share what companies are on my radar at the moment.

1. Albemarle (ALB)

First in the list is a company which was on my watchlists a few times already. However, I never decided to go with Albemarle and chose something else instead.

Shortly about the company from Morningstar:

Albemarle is the world’s largest lithium producer. Company produces lithium from its salt brine deposits in Chile and the U.S. and its hard rock joint venture mines in Australia. Albemarle is also a global leader in the production of bromine, used in flame retardants, and oil refining catalysts.

Sector: Basic Materials

Industry: Specialty Chemicals

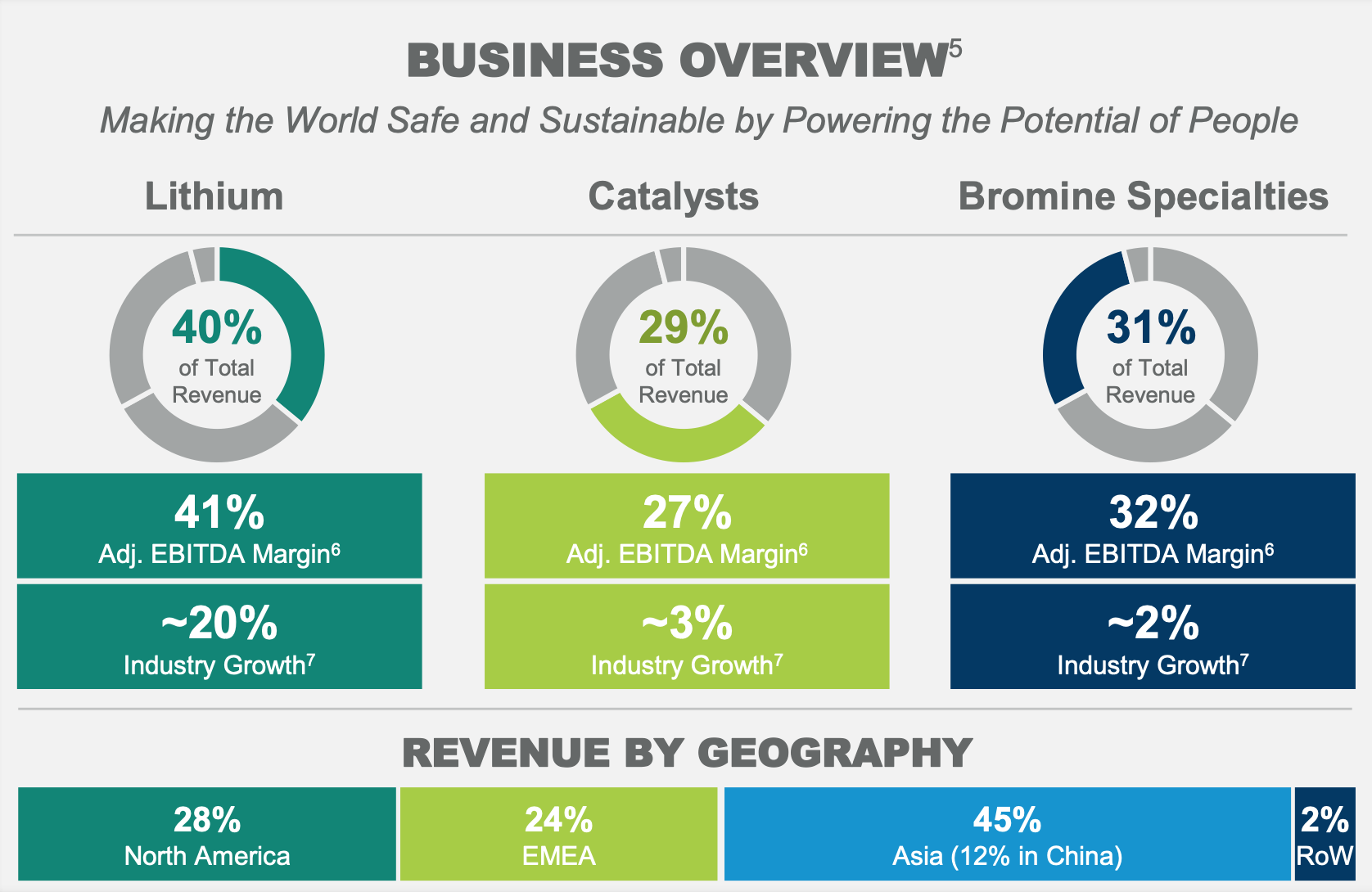

This is a nice overview of the main fields that generate revenue and comparison among regions:

These are the main ratios for Albemarle I am usually checking when evaluating companies. I will also compare it to what it looked like in August 2019 when it was also in my watchlist:

- Current price – $79.57 (was $61.22);

- P/E ratio (TTM) – 14.80 (was 11.96);

- Forward P/E – 13.51;

- Dividend Yield – 1.85% (was 2.40%);

- Payout ratio – 24.25% (was 29%);

- 16-year dividend growth streak;

- Net Debt/EBITDA – 1.83 (was 1.7);

- Market Cap – $8.43B (was $6.49B).

Most of the ratios are looking worse than in my previous review of the company. That’s mainly because price of Albemarle shares increased by ~35% since August. I would have caught it in the bottom if I would have purchased it then but you never know what’s going to happen.

I would like to have this company in my portfolio but would prefer the dividend yield to reach at least 2%.

2. Chevron (CVX)

Next up is an Energy giant. Energy sector was the worst performing sector last year. I am thinking that now may be a time to have another look at this field. Chevron is one of the considerations I have.

Shortly about the company from Morningstar:

Chevron is an integrated energy company with exploration, production, and refining operations worldwide. Chevron is the second-largest oil company in the United States with production of 3.0 million of barrels of oil equivalent a day, including 7.2 million cubic feet a day of natural gas and 1.8 million of barrels of liquids a day. Production activities take place in North America, South America, Europe, Africa, Asia, and Australia. Its refineries are in the United States, South Africa, and Asia for total refining capacity of 1.6 million barrels of oil a day. Proven reserves at year-end 2018 stood at 12.1 billion barrels of oil equivalent, including 6.8 billion barrels of liquids and 31.6 trillion cubic feet of natural gas.

Sector: Energy

Industry: Oil & Gas Integrated

US energy stocks have underperformed general market over the past decade. They only represent ~4% of S&P 500 market capitalisation now, compared to ~12% back in 2010. Growth in crude oil output in US doubled in the meanwhile.

There are basically two alternatives of what could happen next. Either investors will keep looking away from energy stocks, and renewables will take off, or investors will be attracted by higher dividend yields and will bet that strong companies will get back on track. I am leaning towards the latter category.

This is how the main ratios/numbers are looking at the moment:

- Current price – $111.85;

- P/E ratio (TTM) – 16.04;

- Forward P/E (1 Yr.) – 17.78;

- Dividend Yield – 4.25%;

- Payout ratio – 68%;

- 32-year dividend growth streak;

- Net Debt/EBITDA – 0.8;

- Market Cap – $211.49B.

I like that Chevron’s balance sheet is not overstretched and they are being quite conservative with debt levels. I recently analysed Occidental Petroleum which recently acquired Anadarko Petroleum. Chevron was the company which walked away in the bidding war when it decided that the price is too high.

3. Exxon Mobil (XOM)

Next in the list is another energy giant which I already have in my portfolio. However, my position is quite small (close to 3% of portfolio). Also, it’s one of the few positions that lost some value since I purchased them, so I would lower my cost basis if I added to it now.

Shortly about the company from Morningstar:

ExxonMobil is an integrated oil and gas company that explores for, produces, and refines oil around the world. In 2018, it produced 2.3 million barrels of liquids and 9.4 billion cubic feet of natural gas per day. At the end of 2018, reserves were 24.3 billion barrels of oil equivalent (including 4.2 billion for equity companies), 65% of which are liquids. The company is the world’s largest refiner with a total global refining capacity of 4.7 million barrels of oil per day and one of the world’s largest manufacturers of commodity and specialty chemicals. It operates its business divisions in North and South America, Europe, the Middle East, North and sub-Saharan Africa, and the Asia-Pacific.

Sector: Energy

Industry: Oil & Gas Integrated

Similar to Chevron, it is also underperforming the general market for the last years. This is how its ratios are looking at the moment:

- Current price – $65.58;

- P/E ratio (TTM) – 19.11;

- Forward P/E (1 Yr.) – 28.59;

- Dividend Yield – 5.24%;

- Payout ratio – 101%;

- 37-year dividend growth streak;

- Net Debt/EBITDA – 1.45;

- Market Cap – $277.48B.

4. Walt Disney Company (DIS)

Final company in the list is a well known name in the world – Disney. Shortly about the company:

The Walt Disney Co owns the rights to some of the most globally recognized characters, from Mickey Mouse to Luke Skywalker. These characters and others are featured in several Disney theme parks around the world. Disney makes live-action and animated films under studios such as Pixar, Marvel, and Lucasfilm and also operates media networks including ESPN and several TV production studios. Disney recently reorganized into four segments with one new segment: direct-to-consumer and international. The new segment includes the two announced OTT offerings, ESPN+ and the Disney SVOD service. The plan also combines two segments, parks and resorts and consumer products, into one. The media networks group contains the U.S. cable channels and ABC. The studio segment holds the movie production assets.

Sector: Communication Services

Industry: Entertainment

Disney had a nice run during last year, especially since April, when it announced its new video streaming service – Disney+. Since launching in November 2019, the streaming service already attracted ~25 million subscribers. According to Hollywood Reporter, it’s expected to hit 100 million by 2025. The fact that Disney+ app was downloaded 41 million times already says a thing. I think the service is especially attractive to families with kids, as it has so much family-friendly content.

This is how its ratios are looking at the moment:

- Current price – $136.74;

- P/E ratio (TTM) – 21.89;

- Forward P/E (1 Yr.) – 26.18;

- Dividend Yield – 1.29%;

- Payout ratio – 25%;

- 10-year dividend growth streak;

- Net Debt/EBITDA – 2.58;

- Market Cap – $246.85B.

Disney is the most expensive of the bunch if we look at the P/E ratio. It also has the lowest dividend yield. However, I think it may have the most potential in the long-term compared to other companies in my watchlist. As a bonus, it would be different to all other companies in my portfolio.

Summary

There you have it – 4 companies that I am watching at the moment. Two of them are from a lagging Energy sector. They offer high dividend yields but it’s hard to say if they have a lot of potential in the future. The largest lithium producer is a choice if I would bet on the future of lithium. Finally, we have a low-yielding company which is very well known in the world for the content it is creating. This choice would be betting on the future growth potential.

What would be your top choice? What are you looking into now? Thanks for visiting and I would love to read your comments!

1 and 4 good companies with growth potential altough div yield very low 1,something%. 2 and 3 are oil companies. I would look at BP and RDS as well. Went for XOM myself, altough CVX is also a good buy 🙂

Thanks for the comment P2035! RDS was in my previous watchlist, so I was looking into it. It’s not out of consideration. I haven’t decided what I am going to buy yet 🙂

I also looked at REITs lately. Baltic horizon is a good yielder, altough very leveraged.

Thanks for sharing. I am planning to add to some REIT as well in the future, maybe even when my next buy is. Baltic Horizon is looking a little bit too risky to me but we’ll see.

I’m continuing to keep a close eye on Exxon Mobil. It’s an unloved stock with a great dividend yield. The dividend safety is also pretty solid. If share price keeps dropping, I plan on putting about 10% of my total portfolio into it. I don’t want to buy into any volatility before the Friday earnings announcement.

Thanks for the comment Brian! I agree with you that Exxon Mobil is a solid pick. Let’s see how the earnings announcement goes. I would love to add to my position if the price keeps dropping.

Loving me some Disney. 🙂 Even though its a high price its one of those companies that will probably be in my grandchildren’s portfolio.

And the idea of getting something back from Disney after looking around in my house is ….appealing! 🙂

Haha, good point Mr. Robot 🙂 Yes, the price is pretty high and I wouldn’t get much dividends at first. But on the other hand, we are dividend GROWTH investors, not just dividend investors 🙂