March is over, so it’s time to review how much passive income my portfolio has generated during the month.

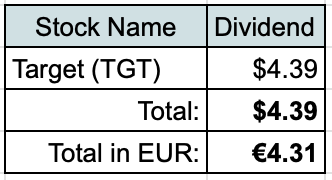

Dividend Income

I am happy to report that I received my first dividend for the year:

Just a tiny amount so far, but you have to start somewhere.

Keeping with the theme I used to do before, I like to compare received dividends to actual expenses our family had.

€4.31 from Target would cover 0.28% of our expenses on Food for the last three months.

It’s a fun exercise to have and see how the amounts change when the time goes by. Hopefully, one day received dividends would be able to cover more meaningful portions of our expenses.

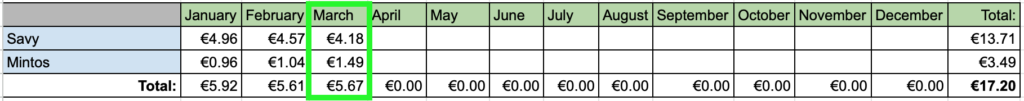

P2P Lending Income

At the moment, the biggest part of passive income comes in the form of interest from P2P lending. Let’s see how much interest I received during March:

Interest from P2P lending generated €5.67 this month.

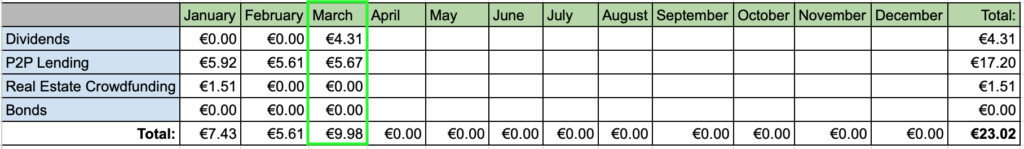

Passive Income Summary

To add it all up, this is how passive income looked like for the month:

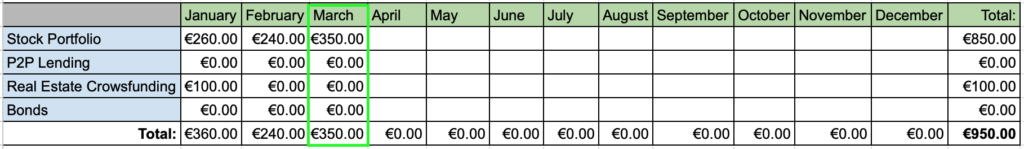

Investments and Portfolio Contributions

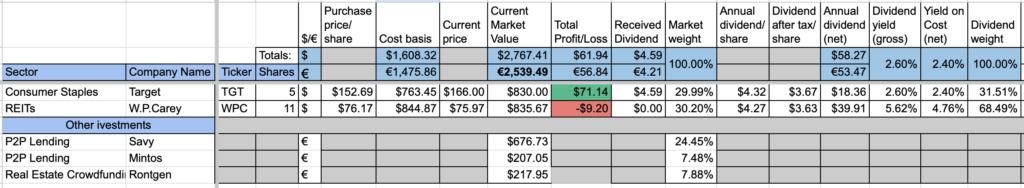

During March, I contributed €350 to my investment account. I used this amount and previous savings to initiate a new position in my portfolio. On the 22nd of March, I bought 11 shares of WPC at $76.17/share (+$7 in commissions) for a total of $844.87 (€771.85). This purchase adds $39.90 to my PADI (Projected Annual Dividend Income) after taxes. You may read more about the purchase here.

And this is how my portfolio contributions are looking so far this year:

My target is to contribute at least €5000 to investments this year, so I am behind the schedule. It turns out harder than anticipated, especially since we are still buying stuff for our apartment. Furthermore, we are saving for a vacation that we reserved for October. However, I am still hopeful that the contributions will grow as the year progresses.

Portfolio Overview

This is how our portfolio looked like on the 3rd of April:

The value of portfolio is actually lower compared to beginning of last month, even though I purchased a new stock. That’s because I no longer own the bond of Viada, which was worth €1000. I bought it 5 years ago and at the beginning of the month the bond matured, so I received the principal back.

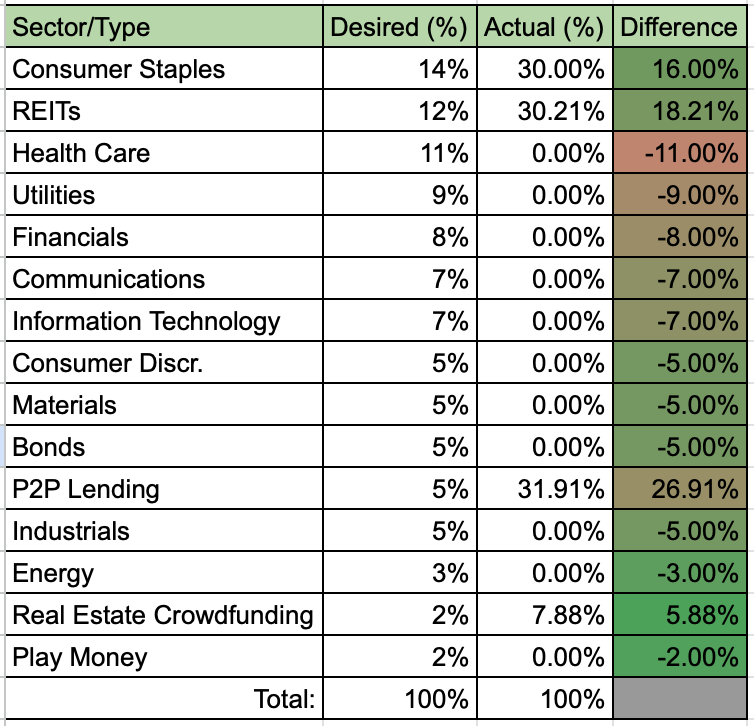

Finally, this is how my current portfolio composition is looking compared to desired allocation in terms of sectors/asset classes:

Desired portfolio allocation shows that my next investment should go to Health Care or Utilities sector. However, this will probably happen in June as the earliest.

Summary

It’s been another small month, as it takes time to grow the portfolio. So far in 2023, I received €17.20 in passive income, which is 9.4% of my goal to receive €183 in passive income during the year. With 25% of the year gone, I am way behind the schedule. However, April should improve the situation a little bit, but we’ll see about that in the next month’s post.

How was your month? Are you happy with the results? Thanks for reading and Happy Easter! 🙂

Hi BI. Another stock added to the new Portfolio… it’s nice to see the expansion. I was wondering why you didn’t spread out your investment across multiple sectors, but I assume it’s because of the commission you have to pay for the transaction. It’s too bad you have to pay the $7 fee. One day it will be $0 for you.

Happy Easter to you and your family as well.

Thanks for the comment, ED!

Yes, I am not spreading out as the commissions at my broker are still quite high. I have an option for a broker with $0 commission but their reporting is very bad (it’s a pain to calculate received dividends in € when it’s time to report taxes). But perhaps I will find some other broker which provides both free transactions and has good reporting.

On the other hand, it keeps me accountable when I need to purchase some shares, so I invest more time into investigating my choices 🙂