IPO is not a common thing in Baltic markets, let alone in Lithuania. However, we had one recently and I decided to participate in it. This is another first for me, as I never bought shares of any company during an IPO.

Let’s have a deeper look at the company I invested to.

Ignitis Grupe (IGN1L)

The name of the company is “Ignitis Grupe”. It’s an international energy company and one of the largest energy groups in the Baltic region. The group’s core activities include power and heat production and supply, power and natural gas trading and distribution, and power system maintenance and development.

Some facts about the company from its website:

- Ignitis Group, by revenue, is the largest group of energy companies in the Baltic States. Group’s companies operate in Lithuania, Latvia, Estonia, Poland and Finland. The Group’s innovation fund invests in energy start-ups in the UK, Norway, France and Israel.

- Ignitis Group gives priority to green energy, aiming to become the region’s main competence centre for new energy and a leader in energy distribution solutions in the Baltic region and beyond.

- Currently, Ignitis Group owns three wind farms operating in Lithuania with a combined generation capacity of 58MW and a 18MW wind farm in Estonia. The Group is also building a 94MW wind farm in the Poland’s Pomerania region and construction is underway of a 60MW wind farm in Mažeikiai, Lithuania.

- The Group owns the Elektrėnai Complex with 1055MW electricity generation capacity. It also operates Kruonis Pumped Storage Hydroelectric Power Plant, which is unique in the region and has a 900MW capacity, and the 100.8MW-capacity Kaunas Algirdas Brazauskas’ Hydroelectric Power Plant.

- The Group’s companies are currently building modern waste-to-energy cogeneration (CHP) plants in Vilnius and Kaunas. The Vilnius CHP Plant will have heat production capacity of 229MW and electricity generation capacity of 92MW. The Kaunas CPH Plant’s respective capacities will be 70MW and 24MW.

- The Republic of Lithuania is the main shareholder of Ignitis Group.

Earnings

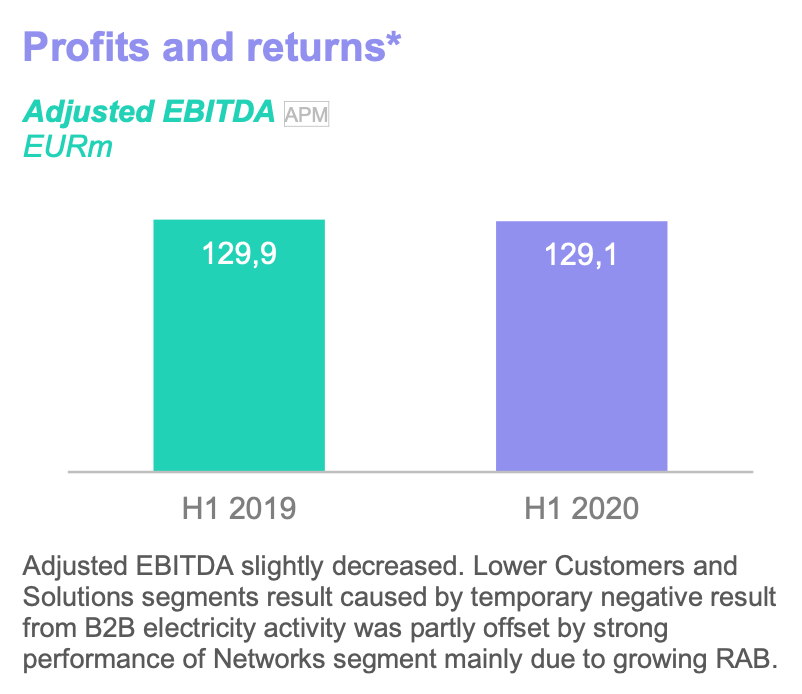

Here are some performance highlights from company’s most recent earnings report:

Even though Adjusted EBITDA slightly decreased compared to last year, I would call this a good result, considering that Covid-19 striked this year.

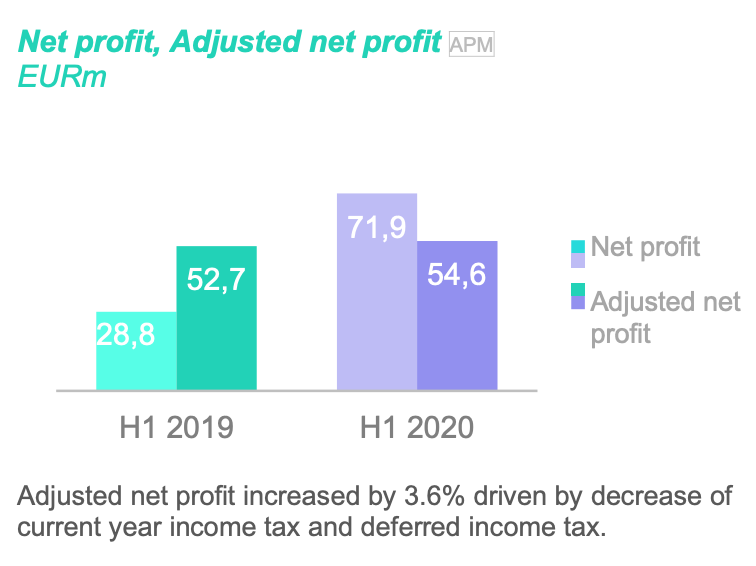

Net Income is also very similar to last year:

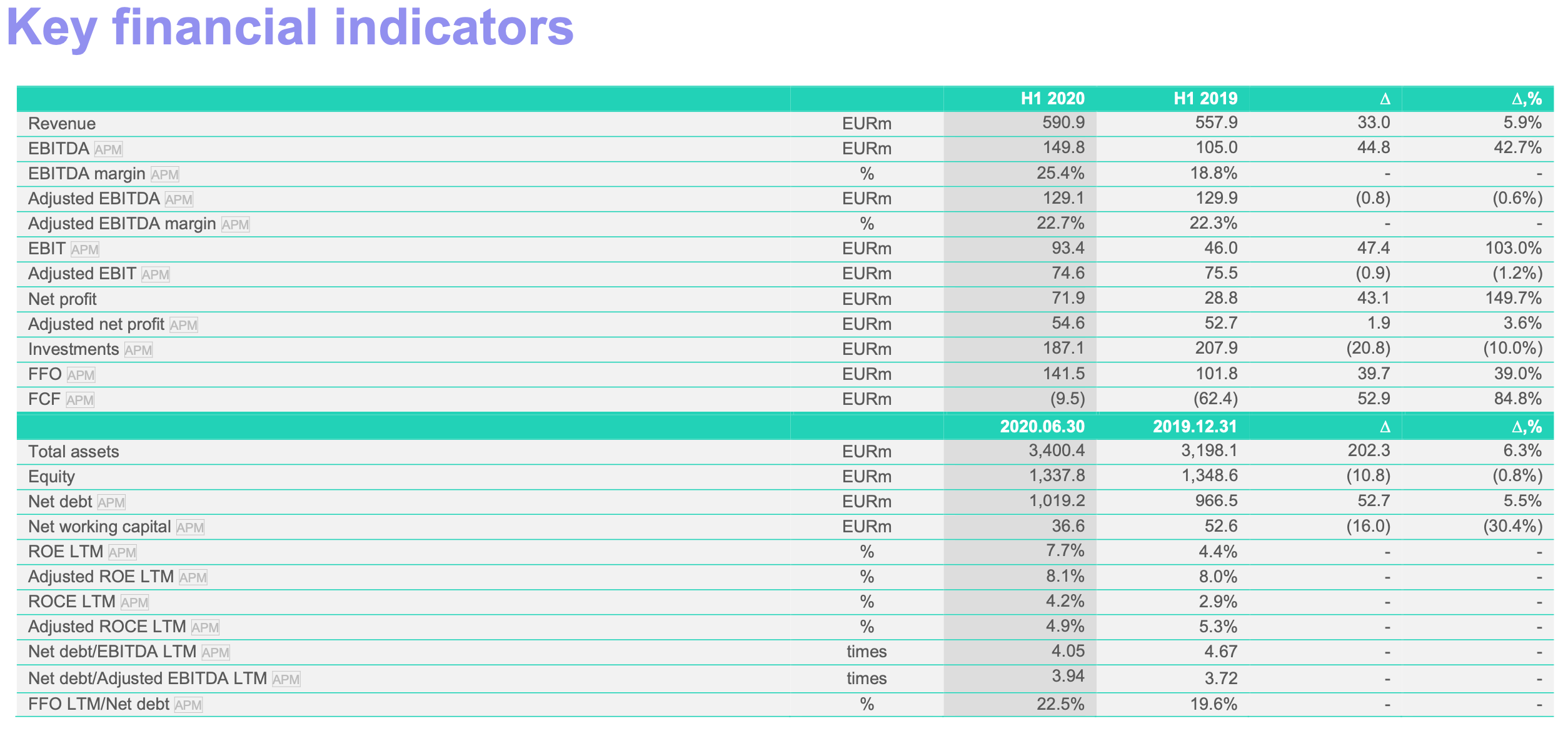

Here’s a nice presentation of main performance indicators for the company, as they stood after the first half of 2020:

Debt

Let’s see how company’s debt situation looks like at the moment.

Current ratio (Current Assets/Current Liabilities) is 1.79 after half-year results, which indicates that company is well positioned to cover current liabilities.

Net Debt/EBITDA currently stands at 4.05, while Net Debt/Adjusted EBITDA is 3.94. Company’s debt level is quite high but that’s normal for a Utility company.

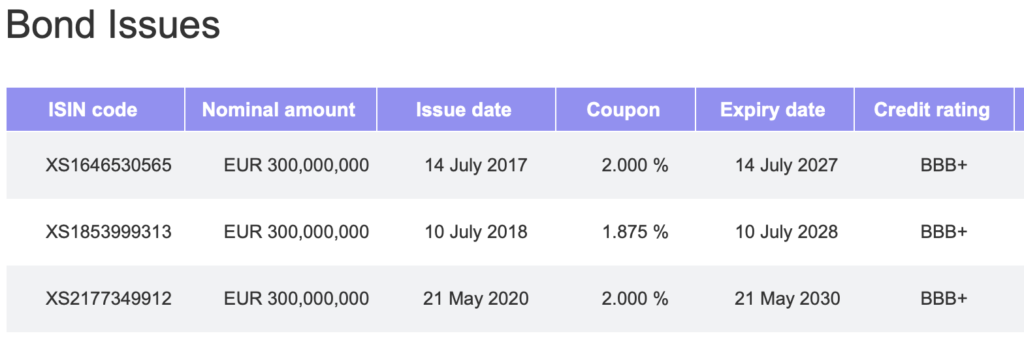

On the bright side, there is a lot of time until most of the debt matures. This is a list of bond issues company currently has:

As we can see expiry date of the earliest bond issue is only in 2027.

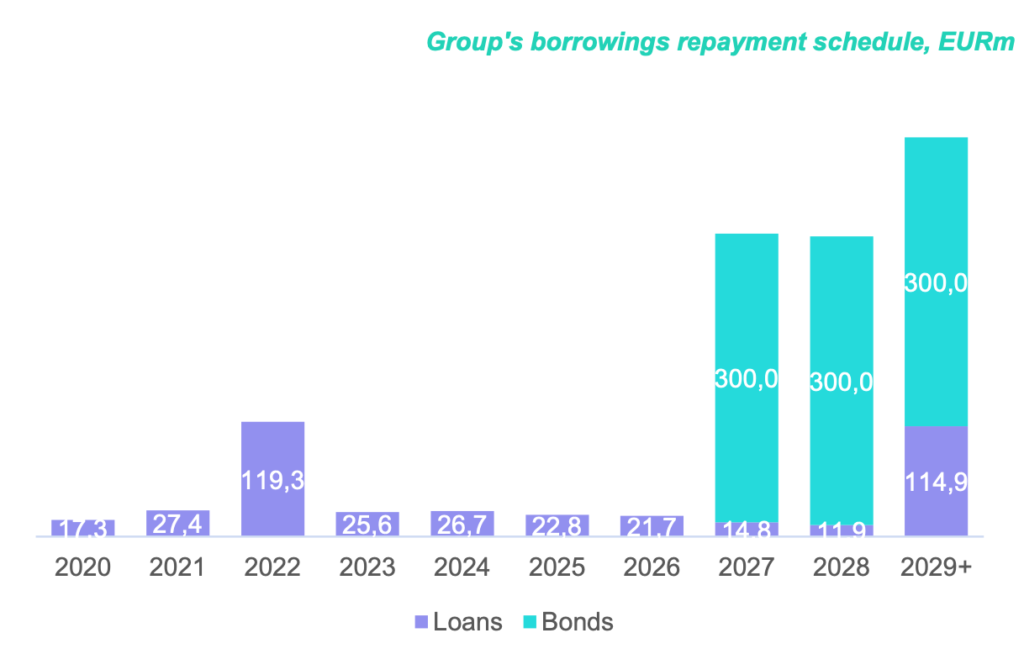

In general, this is how company’s debt payment schedule looks like at the moment:

Back in May of this year, S&P Global Ratings agency re-affirmed BBB+ rating with negative outlook for Ignitis Group. There is a risk for a downgrade if FFO to Debt ratio does not improve towards the threshold of 23%. It was standing at ~19% at the end of 2019.

Looking at the ratios after the latest report, they are looking better – FFO to Debt has reached 22.5%, according to company’s 2020 H2 report.

Dividend

Company is currently planning to pay 80M EUR in dividend, which is 1.13€/share. It means dividend yield of 5% (gross) at the IPO price. It’s not bad and higher than my portfolio average.

Company is also committed to raising dividend, according to their dividend policy: “For each subsequent financial year, dividends will be at least 3 percent higher than the amount paid for the previous financial year“. Of course, this is not guaranteed but I like to see that the company is at least planning to keep raising dividends.

Purchase Summary

The IPO was not a success, so the price was set at the lowest point of the initial range of €22.5-28. I certainly don’t mind to have purchased the shares at a lower price than expected.

I bought 40 shares at €22.5/share for a total of €900. This purchase adds €38.42 to my net forward dividend income, if company sticks to its target of dividend payments.

As an added bonus, it feels good to have a small part of a company which is investing heavily into green energy in Lithuania. I now own enough companies in the Utilities sector, at least for the nearest future.

Have you been buying anything lately? What do you think about my purchase? As always, thanks for reading and I would love to hear from you! 🙂

Congrats. Bougt 25 myself at IPO for 22,5€ 2 days ago doubled for 20,7€. Sad the share price went down even further. Strange why the such deline. Evrything looks good at the company. Unless investors do not trust state for stable dividend or profit on regulated activity.

Congrats to you too, P2035!

I heard something about Estonia’s Swedbank no longer supporting the price, but haven’t looked deeper into it. I am happy to have part of the company and may also follow your example and increase the number of shares if the price keeps below €20.

Share price below 20€ looks very undervalued. Company has great L/T potential. Sad dont have any more capital. Boughr few months upfront of my 200€/mo contribution 🙂

I really love your analysis and breakdown of why you decided to invest. I also love the dividend policy. 🙂

Good luck with your buy!

Thanks a lot, Mr. Robot! I appreciate it 🙂